Better pay up when you get more than 3 hundredths of a percent interest

I have been following along as some of the new rules proposed in the Build Back Better Plan have been published and discussed.

The new law has not been passed by Congress or signed by the president, but a lot of provisions have been spotlighted. In some cases that resulted in removal from the original version, in some cases it illuminated something that was hidden — at least it was for me.

Did you know (and this is the law already — not proposed)?

Banks and other businesses are required to send you a Form 1099-INT if they pay you $10 or more in interest during the year.

Actually, there is no minimum interest payment you can receive and not have to report it. Banks and anybody else who gives you $10 or more in a year has to issue the form, but any interest you earn has to be reported in your tax return, even if you did not receive the form 1099-INT.

I did not know that my bank informs the IRS that I received $10 in interest — Did you?

Well, the other interesting aspect is: Did they report on you recently or not?

For most Americans it is unlikely. Here is why.

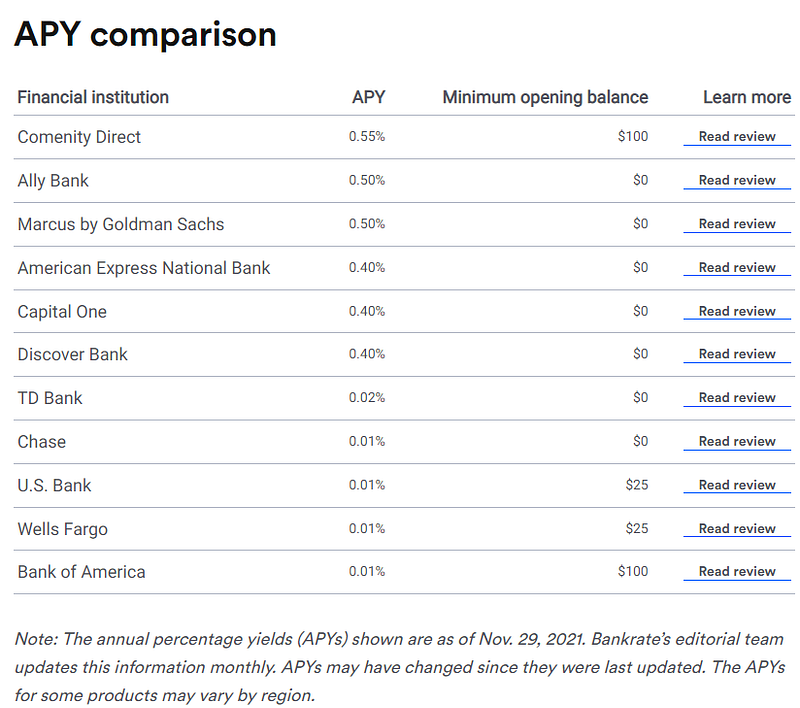

As you can see and probably know the actual interest earned on a savings account has pretty much disappeared in the last few years.

When does the automatic reporting rule actually get triggered?

Anybody who follows our website, YouTube channel, or social media postings or has heard me talk about our investment strategy in podcasts knows that I always suggest accumulating about $30,000.00 and then purchasing the first investment property that performs well and gets you onto your journey to your Time Freedom Point.

Let’s just say, for argument’s sake, that you have accumulated this first investment threshold or for some other reason accumulated this amount in your savings account and you did not spend it for a year.

Did your bank report you to the IRS?

Looking at the image above, I can tell you: if your savings account is with

- Bank of America

- Wells Fargo

- US bank

- Chase Bank or

- TD bank

The answer is: No — because you did not even make $10 on your $30,000.00 savings. The government still expects you to report any money you received anyway in your taxes because it’s the law.

If your account was with Discover bank or any other bank that paid you 3 hundredths of a percent in interest, you would have exceeded the threshold and probably received a form 1099-INT as well as being reported to the IRS.

Why do they want to know and what’s coming next? One proposal was to report not only your $10 interest on your savings account but any transactions in your bank accounts that exceed $600 per year.

The Biden administration is actively pushing Congress to require banks to report to the Internal Revenue Service on the account activity of a huge swath of Americans. This unwarranted snooping would be an invasion of privacy, and lawmakers should make sure it doesn’t happen.

Treasury Secretary Janet Yellen and the IRS have asked Congress to mandate banks send along annual inflows and outflows from accounts with at least $600 or $600 worth of transactions. That’s a low bar that would expose the majority of bank accounts to additional scrutiny.

The administration claims this would allow the IRS to conduct audits more efficiently.

In reality, it’s all about the federal government trying to squeeze Americans for additional tax dollars in an effort to fund Democrats’ $3.5 trillion budget wish list. Or as Yellen phrased it in a letter to Congress, the government has “a shortage of necessary funds for key national priorities.” Biden officials estimate this could bring in upwards of $400 billion over a decade.

As you can imagine, this idea did not get a lot of positive feedback. If your kids run a lemonade stand and deposit the gains — all of the $610 they made in a savings account because you want to teach them the value of savings and hard work, your bank will report your kids’ account to the IRS.

That sounds like a dictatorship if you ask me. Not to worry, there is a fix after the first draft caused massive push back, as Bloomberg explains:

Democrats in Congress are considering a plan that would require banks to report accounts with at least $10,000 to the Internal Revenue Service — well above the Biden administration’s proposed $600 threshold — while also exempting some common transactions from the law.

The narrowing of President Joe Biden’s proposal to require financial institutions to report account flows the IRS responds to concerns that the plan would give federal tax collectors information used to single out taxpayers over small amounts of unreported income.

“The idea is to build in guardrails so that people at the lower end are not targeted. This is about people at the upper end,” Neal said in an interview. “We do think we can raise the level of compliance from everybody with more procedural requirements.”

So, “…that people at the lower end are not targeted”. What does that mean?

Let’s say you have a regular job. That’s about 2000 hours per year. If you get $9/hr, well above the federal minimum wage, you will have made $18,000.00. Most people would get that wage deposited into a bank account by the employer and then begin paying for normal living expenses.

If you are at $9/hr or above you are currently considered “upper end”.

That’s where the level for tax cheats starts and where the government needs to know what you do with your money and how to get more of it from you.

Can we avoid this from happening? Probably not.

We will see more and more rules and laws and tax codes that increase the ability to collect more and more of your income in taxes, fees, fines, etc.

The reason is the never-ending printing of more money. Not physically printing on paper, but the creation of more money in the monetary system.

How much — try $1 million per minute.

That’s how much and that’s what the government needs to find new and more creative ways to take more of your money away from you.

What’s the cure?

I think a lot of people have asked that and triggered what’s now known as “The Great Resignation”. Here is what I recommend:

Don’t receive your money from a job. If you follow our passive income investing strategy using residential real estate in well-performing locations around the country, your income will not come from work and you have full control over how to generate it and how to use it.

Yes, it might take about 5 -8 years of discipline to be able to purchase the assets you will need, but I feel it sure beats doing a great job for a company and getting less and less for it.

Let me not even start to throw inflation into that picture.

By the way, the latest update for this taxation and snooping proposal is that it will not pass in 2021. Let’s all hope it never will.

If you like to learn more about how we get to the Time Freedom Point and will not care about the interest on our savings account after we reached it, get in touch, and let’s have a conversation about it.