Have prices gone too high?

This week two apparently opposing questions came up in conversations I had with some of my mentoring clients and as a guest on a podcast.

The one question was: Why should people rent a house you bought as an investment when they can buy one themselves?

The other question was: With the prices as high as they have gotten, can I even get started? — wouldn’t the down payment already exceed what’s reasonable for normal people like me?

The first question is easier to answer.

I believe people in the western world are conditioned and encouraged to be consumers. We are told to buy things to keep the shops on Main Street open.

We see commercials suggesting that our lives are better, and we will feel better when we buy new things — ideal all the time.

There are holidays invented to get us to buy more stuff. Valentine’s Day was yesterday, and it is mainly a consumer holiday. Same as Black Friday.

Back to school used to be the time to buy school supplies that students need in the classroom. Now it’s become a fashion event where kids of all ages are supposedly competing with each other to win the prize of the person with the newest stuff at the beginning of the school year.

What does this consumerism on steroids have to do with the ability to rent or buy a house?

Two things come together that reinforce each other.

- If you want to be hip and supposedly respected in the community you belong to, you are strongly encouraged to spend your money to consume and keep up. That reduces the amount of money you can save — even if you have good intentions.

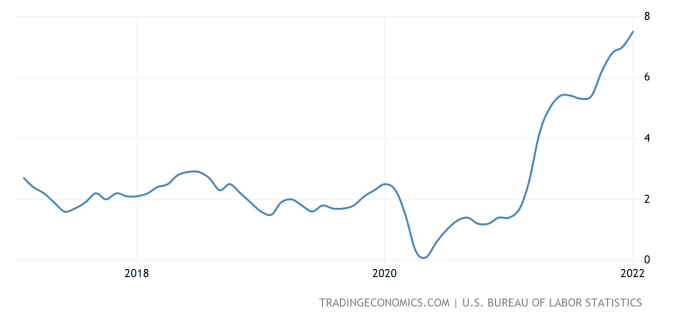

- In your drive to keep up and spend money on items that lose massive value as soon as you carried them home, you are facing increasing prices. As we just learned, those increases have reached a 40 year high, which makes it even harder to have anything left to save at the end of the month. I always suggest taking 10% of your incoming money and putting it into a savings account. That’s a great approach but if you run out of the remaining 90% before the month is over, you have very little choice but to tap into this 10% to keep going.

Taking these things together results in a situation where a lot of people realize that they just have barely enough money to cover all the expenses of life as they define it (including the consumer holidays). In many cases, it even means you have to ask for a raise to be able to maintain your current lifestyle.

The end result is that you have less rather than more money in your savings account and might even have to tap into those remaining savings to cover increased costs.

Keep in mind that part of the 7.5% inflation shown above includes increases in rent.

The bottom line is, no money to save to build a sum that would allow you to make a down payment on a house.

Is that likely to change any time soon? I don’t think so. Even if inflation is coming down from 7.5% to let’s say 3% — 4%, you will still have a hard time switching from renting to owning. The reason is that the reduction in inflation is going to come from an increase in interest rates by the FED.

So, now you could maybe save the 10% I recommend but the cost of the mortgage is running away from you.

Going back to the second question about getting started in these times? My answer is a resounding: “YES” — but in two different ways.

- For any reader who has and can reasonably assume to have more money than you need to consume (and is hopefully somewhat frugal, not following the crazy consumerism we are led to believe we need to exercise to help the economy), you want to take even small amounts of money and put them into what I call the “Accumulation Accounts”.

2. For those readers who happen to be in the consumer conundrum without any significant amount left at the end of the month, the answer is “YES” as well, but with a twist.

Let me tell you what I mean by “Accumulation Accounts” — yes, plural.

I used to say: Put 10%–15% of any money that comes into your household into a savings account and keep accumulating until you have enough money to purchase your first real estate investment. That used to work fine until the interest rates went down very fast and inflation started to rise. I still suggest having that bank account and you can either make it a savings or a checking account.

Now I say: Get yourself an account in a tokenized residential real estate platform together with your savings or checking account.

For those of you who don’t have any significant amount these days to save, I encourage you to look at all your expenses and identify anything that you might not need desperately. I bet you can find $100, maybe more each month. Instead of using that money to consume what you used to, buy one or two tokens in tokenized real estate. A single token costs $50.

This is one way to participate in Real Estate Investing. If you want to learn more about the details and understand the principles, how to select the property you invest in, etc., you can contact me, or our team and I am happy to help.

The beauty of this approach is that the return on your token purchases is typically above 7%. That means your money is not losing value and as you keep accumulating, you will slowly get to a point where you can actually afford the down payment for your house.

I mentioned earlier that this approach applies to two categories of readers.

We just covered those who have just enough money to consume but not much to save and definitely not enough to make the down payment for a house.

For the other group of readers who still can participate in Real Estate Investing, the same approach and question applies, but with a little twist.

You came to me to learn how to invest in real estate out of state using turnkey providers and you bought your first property, maybe even two or three.

You also ask if you can or should still keep investing? I again say yes. Price is not the measuring stick — Performance is. As long as you can find properties where the ratio of the purchase price and rental income is such that performance is high, keep investing.

In your case, you are on your path towards the Time Freedom Point where your passive income exceeds your living expenses, but you aren’t at the finish line yet.

You are getting passive income from your existing investments and need to accumulate funds to get ready for your next deal. Instead of accumulating those funds in a checking or savings account, you should use any money you can save from your regular income plus your net cash flow and “park” it in a tokenized residential real estate investing platform account as described above.

You will maintain the buying power of your money, keep sharpening your understanding of the selection of well-performing properties, and enjoy rental income while you grow the amount towards your next down payment.

For anybody asking why I said you still should keep the savings or checking account, here is your answer: When you reach an amount large enough to buy your next real estate investment you will have to transfer the funds from your tokenized real estate investment account to a savings or checking account to send to the title company as part of your house purchase.

In a nutshell:

No, Real Estate is not too expensive as long as you can find residential properties that perform well.

To enable yourself to make these investments, use our two-part accumulation approach combining a bank account with tokenized residential real estate and begin your journey that way.

If you like to learn more about how that works and how we can help you reach your Time Freedom Point, please get in touch.