A tale about financial consciousness

We are living in really unusual times. Times that contain developments that have in part existed before but have been “in hiding” for a long time.

The story of “The Raiders of the Lost Ark” comes to mind — my mind.

The virgins I am talking about probably don’t know what the heck the take of this story is. Here is a short summary of the plot from 1981:

On a quest for the legendary Ark of the Covenant- resting place of the Ten Commandments- whose supernatural powers, legend says, can wipe out entire armies. The U.S. Government turns to Dr. Indiana Jones, for the mission. Relentlessly pursued by Hitler’s henchmen, Indy infiltrates their massive digging operation in a race against time to discover the Well of the Souls, where the Ark has lain undisturbed for centuries.

After finding the Ark and then losing it to the Nazi’s, the Ark is transported to a secret place for opening. At an elaborate ceremony atop the mountain, Indy and Marion, tied to a pole, can only watch as the Ark is opened, but it contains nothing but sand, the remains of the stone tablets. No sooner is it opened, however, than its spirits suddenly appear. Indy, remembering an ancient code that requires people to close their eyes and not look at the now-freed spirits, yells for Marion to do the same. The two withstand the mayhem that ensues as the energy of the Ark surges forth and its spirits attack the now-terrified Nazis, killing the entire contingent. Toht and Dietrich’s faces melt as they scream in horror. Belloq himself explodes. The energy mass surges high into the night sky, carrying every corpse toward the heavens, before returning to the Ark and resealing it, leaving Indy and Marion drained but freed.

The Ark, after given to the US Army team that had recruited Indy and Marion, is sealed in a wooden crate, stamped with a government serial number and simply wheeled into a large warehouse containing thousands of similar-looking crates.

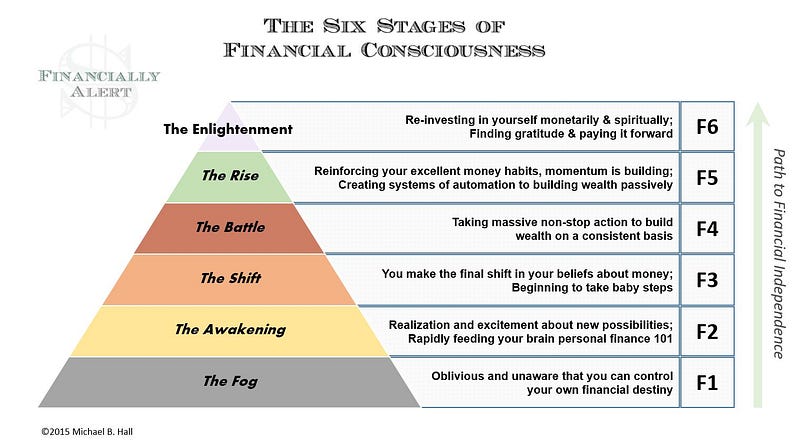

Moving to 2022, we face a situation similar to the story of the Lost Ark. To understand it and develop solutions, we need to understand financial consciousness. There is a lot written about it, but a picture often replaces 1000 articles. Take a look at the picture/graphic below:

Let’s say you were born in 1981 when the movie was a hit in theaters. For most people, the first 20 years of life are focused on all kinds of other things and you are in The Fog of financial consciousness.

For the next 10 years till you hit your Thirties, you move towards the Awakening and what did you find in your late twenties and early thirties?

The Great Recession. It was a period of marked general decline (recession) observed in national economies globally that occurred between 2007 and 2009. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. One result was a serious disruption of normal international relations.

The causes of the Great Recession include a combination of vulnerabilities that developed in the financial system, along with a series of triggering events that began with the bursting of the United States housing bubble in 2005–2012.[3][4] When housing prices fell and homeowners began to abandon their mortgages everybody felt the world of finance is coming to an end.

You were basically a virgin awakening to the world around you and you saw the Great Recession, even though you probably weren’t affected directly very much.

When you look into The Free Dictionary for the search terms “virgin” you find the following:

A person who is inexperienced in a given activity or field.

After the Great Recession, you started to look more seriously into money and realized that you had a ton of student loans and credit card debt, but you also heard and read headlines like this:

- The government is helping to get the economy back into gear with TARP — The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President George Bush. It was a component of the government’s measures in 2009 to address the subprime mortgage crisis.

- The FED keeps lowering interest rates since 2008 to stimulate the economy, resulting in the FED funds rate at zero percent for the last few years

- Quantitative easing (QE) is going to help us all. It’s a monetary policy tool in which a central bank attempts to stimulate growth in the economy by buying bonds or other financial assets in the open market. When the central bank purchases assets, the money they’ve spent gets released into the market, increasing the money supply in an economy. QE is an unconventional monetary policy tool that’s usually used by a central bank when traditional tools–like lowering interest rates–are no longer effective or an option.

- Quantitative easing will support economic growth. In the U.S., the Fed notably conducted multiple rounds of QE after the 2008 financial crisis. The U.S. central bank also embarked on a QE program in 2020 when quarantine measures were put in place due to the Covid-19 pandemic.

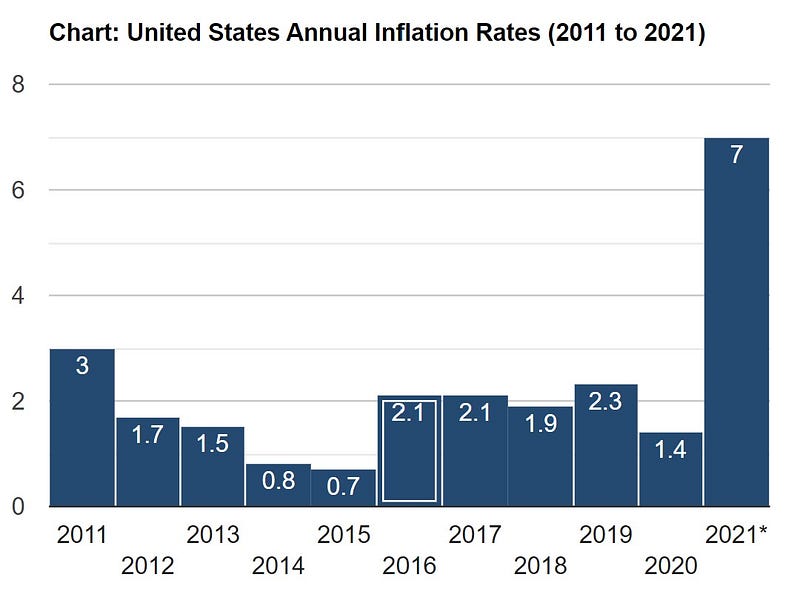

- FED takes action to lower inflation towards the desired of 2%. The

The FED was constantly adjusting policy to achieve that goal. Here is how they did until 2021:

And now we are in 2022.

You are a financial consciousness and financial allocation virgin experiencing a new financial world order for the first time.

Here is why. What have you not experienced in your life so far?

- You are in the middle of an environment where we have 7% inflation, higher than in your lifetime.

- You are in an environment where the FED will increase the interest rate potentially 5–7 times in the next 2 years.

- You are in an environment where the 30% zombie companies of the S&P500 will no longer be able to get new loans to pay the interest on old loans. They will drop like flies going bankrupt in 2022.

- You are in an environment where the stock market is reaching new volatility records with the exchanges fluctuating 2000 points in one day because nobody has any ideas what going to happen.

- You are in an environment where crypto markets have moved up from almost nothing to more than $79,000 (BTC), and then fallen all the way back to below $40,000.

- You are in an environment where the big powers of the world, Russia, China, and the US are getting ready for war over Ukraine, Taiwan, ISIS. That’s something you only heard about in school as a tale of the “Cold War”.

With all these things happening at the same time, you struggle to comprehend and get a grip on what’s happening. That’s normal for a virgin.

What should you do?

As shown in the graphic above, you will need to fill your brain with financial information, start taking baby steps to accumulate value assets, even though that’s hard to do in times like this.

Here is the sequence I suggest following:

- Start with tokenized residential real estate,

- Accumulate enough down payment to buy turnkey renovated houses, single, duplex, triplex, fourplex, depending on how much money you can accumulate. Make sure any asset you buy is providing positive cash flow.

- Keep accumulating down payment money and now purchase built-to-rent properties in high-demand states like Florida, Texas, Utah.

- Identify great markets for short-term rentals and transition to buying assets that can create positive cash flow as short-term rentals as well as long-term rentals and find a premium host to manage your properties in that model.

- Identify suitable turnkey residential short-term assets in great places around the world, like the Caribbean, Mediterranean, etc. where you can spend time on vacation but also generate positive cash flow when you are not there.

- Allocate 10% of your cash flow and other available funds to monetary assets — 5% Gold, 5% Bitcoin

In this environment, it is going to take time to move from F2 to F5 or F6, but it is worth it.

In the process, you have every chance to get rid of that feeling of a virgin and become an enlightened expert. If you like help, my team and I are here happy to help.