The time value of money and asset selection makes all the difference

As the year 2021 comes to an end, most people are looking forward to some time off from work.

We want to rekindle what happened, reflect on things that went well and some that were not so great.

We are getting ready to plan for the new year and what’s ahead.

In my household and our business, after a lot of uncertainty about economic development in 2020 and the early parts of 2021, we have set out to significantly increase our portfolio of value holdings.

When I talk about that on podcasts and interviews, people always ask:

“But are we not in a bubble? Haven’t real estate prices increased so much that it is now really expensive to buy? Didn’t we miss the boat and should have bought a few years ago? How can you even find well-performing assets that you always preach to look for when purchasing real estate?

These are all brilliant questions, and they are our questions too. Some answers might surprise you, but I think they also teach several important lessons.

Here is one that I strongly believe applies almost universally:

“Pay attention to the historical record and put it in perspective with the current data and predictions of the future!”

Most of you reading this article will remember the 2008 financial crash and crisis in the economy with millions of foreclosures and the mortgage bubble bursting.

That became daily mainstream media news in 2010 and 2011. If you look at the historical data, you will see that it had started earlier and taken longer.

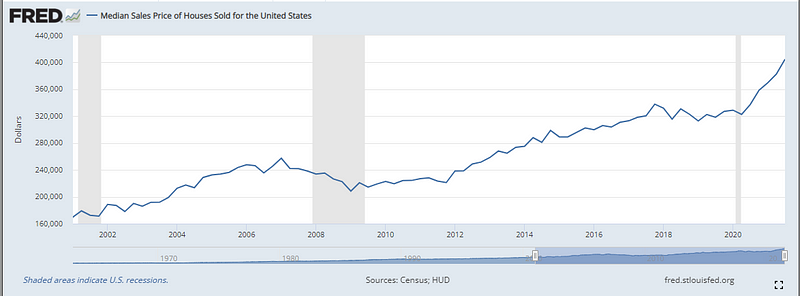

The peak you see in the graphic above was in March 2007 at $247,400.00 and prices went down after that, all the way to the same level as the end of the year 2003 with $208,000.00.

They reached the pre-crash level again at the end of 2013. That means that a house you bought at the median price at the absolute top of the market in 2007 did not start making you any money in terms of market value for about 6 years.

That has been the worst case in recorded history.

It begs the question: “What do we learn from it?”

My lesson or answer:

Be very aware of the goal and the associated ‘term’ of your investment.

Our overarching strategy is to develop an asset portfolio that will provide so much passive income on a monthly basis that we no longer have to exchange time for money and have the freedom to do what we are passionate about — for the rest of our lives. (And hopefully the lives of our heirs.)

There are two important nuggets in this statement that explain why we keep buying assets now and keep doing it in the future.

There are two time periods in this strategy.

- We need to accumulate the value-assets to reach our Time Freedom Point.

- We can live the rest of our lives focused on our passions.

How long are we talking about? Let’s assume you are 40 years old and decide to apply our strategy as described above.

To start you have $50,000.00 in your savings account (maybe from saving 10% of everything you earn, like the richest man in Babylon did, or you sold some stocks that performed well, or maybe you and your spouse received a nice year-end bonus.)

You invest this money into well-performing residential real estate following our Out Of State Single Family Residence Turn Key (OOS SFR TK) strategy. After that, you use future savings and passive income from your investments to purchase 1–2 properties each year for the next 9 years. After a total of 10 years, you own 15 well-performing properties that generate the passive income you need to stop exchanging time for money.

Now you are 50 years old and can look forward to about 30 years of living your passion, maybe even a little longer.

As the mortgages on your properties are paid off one by one over the years, your passive income will keep increasing. As rent increases together with inflation your passive income will keep increasing even more.

So going back to the lesson above, you can see that you will purchase your assets for easily 20 or 30 or even 40 years.

Yes, you can sell an older asset at some point and get a newer one, but generally, this approach works best for long-term investing.

The 6 years it took to live through the valley of values during the worst real estate crisis in history would not have hurt you based on these time scales, regardless of when you bought.

That puts in a good foundation for anybody asking today:

“Is it too late to start investing?” — the answer is no — actually the opposite. Here is the reason we are buying now more than before.

There is one minor aspect that is important to keep in mind.

I always speak about performance when discussing real estate purchases.

Performance is the ratio of the purchase price and the rent income.

If you buy a property for $150,000.00 and you receive $1500/month in rent, the performance is 1%.

If the price is higher or the rent is lower the performance will be reduced.

With that in mind, we need to be aware that we currently have a situation where purchase prices have gone up dramatically in the last 5 years while rent has not gone up nearly as much.

At first glance that might look like a bad thing but, in reality, it is a wonderful opportunity and underlying our drive to purchase now and in the future.

The purchase price of real estate is a function of supply and demand. In the US we have built way too few new houses since that last crisis, resulting in a huge imbalance in supply and demand. That’s why prices have gone up so much.

Rent is a function of the ratio of income versus expenses. Most people try to keep the rent at less than 50% of their monthly income. That has gotten harder and harder as rents have increased. The cure for that dilemma is an increase in wages. Anybody following the news can see that this process has started.

Now add inflation, which is the main reason employees demand higher wages. Inflation applies to rents but also to all other expenses of life. That’s why employees switch to jobs that pay better or demand increases in their hourly rates and salaries.

Putting it all together, here is what we would like to find in the current environment from the perspective of a value investor who focuses on real estate:

- We want assets that are as new as possible because we need them to last decades.

- We want the properties to be in locations that are attractive to the public (with in-migration as a powerful component) so we will have a large and growing rental pool.

- We want to have a great perspective and expectation of future rent increases (both from continued inflation above historical levels and increases in wages for our tenants).

- We want low-interest-rate levels and plenty of money in the lending markets to get very low-interest-rate loans for our mortgages to achieve maximum leverage at the time of purchase.

When you take that into consideration, we are currently in the perfect scenario and market to buy newly built properties in desirable locations across the country.

That’s exactly why the glorious points below excite us while we are buying now:

- We believe inflation is here to stay — the same as Jerome Powel recently discovered.

- We believe that people make clear choices where they want to live and gain more freedom, especially anybody who can work from home now and in the future (think sunshine and low taxes or no taxes).

- We believe that we will see wage increases and continued labor shortages, allowing us to adjust the rents upwards while our costs remain stable. This is a compromise on immediate performance. Yes, a brand-new house in Memphis might cost $150,000.00 and only achieve $1250 monthly rent, but as wages and inflation increase, the rent will keep increasing as well, and probably get to our desired 1% level after 3 years. We will compensate some of the pain of that lower performance in rental income by the continued lack of inventory, especially of new houses combined with inflation, which will increase the value of the property during those 3 years by approximately $37,500.00. If you were to get this increase in value paid monthly as an additional sum to your rent, it would be about $1000/month extra. It would take too long to explain in detail here, but this equity gain will help you speed up the speed of your purchases of houses in the future, which gets you to your time freedom point faster or you will have a higher passive income when you reach your point on the calendar.

I can’t tell you how much longer we will have low-interest rates (not much longer if we believe the FED), can find new build properties in desirable locations at prices that allow us to reach our performance goals and increase in value at least at the rate of inflation, if not more.

Bottom line:

Now you know why we are buying in this market and if you like to join us or learn more about the exact steps we take and who we are working with, please let me know. We are happy to help you do the same.

Merry Christmas and Happy New Year!