Will real estate prices keep increasing?

The phrase is commonly attributed to John F Kennedy,[1] who used it in a 1963 speech to combat criticisms that a dam project he was inaugurating was a pork-barrel project.[2][3] However, in his memoir Counselor: A Life At The Edge Of History, Kennedy’s speechwriter Ted Sorensen revealed that the phrase was not one of his or the then President’s own fashioning. It was in Sorensen’s first year working for him, during Kennedy’s tenure in the Senate, when Sorensen was trying to tackle economic problems in New England, that he happened upon the phrase. He wrote that he noticed that “the regional chamber of commerce, the New England Council, had a thoughtful slogan: ‘A rising tide lifts all the boats.’” From then on, Kennedy would borrow the slogan often.

We have seen that the current tide that is rising prices. Signs of inflation have clearly become visible and now a lot of people wonder how long will it last, how high will it go, and how much will we all be affected. I am not the first person to point out that government statistics about this topic are massively manipulated to give the public the impression that inflation does not exist or is minuscule. That has never been true. On the other hand, in the last decade inflation was pretty contained overall, maybe except for food prices.

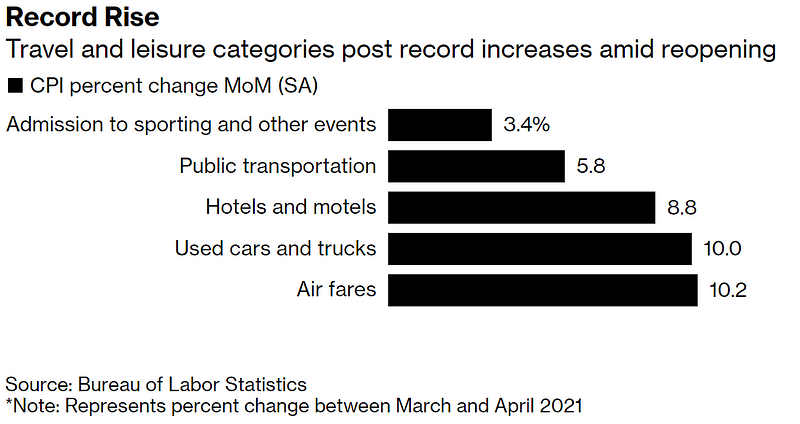

Every so often new statistics are released and one of those opportunities to analyze the numbers came along just recently.

Unless you were the odd person looking to travel or stay in hotels during a pandemic, this info is probably not that useful. It does not show what we are really consuming on a daily, weekly, monthly basis.

The trick when reading this graph is in the abbreviation that is not explained. You are supposed to know what MOM (SA) means. It stands for “Month over Month (Seasonally Adjusted). That means this increase is for just 1 month and a factor is applied to add or subtract according to the season in the year — in this case spring season.

If this increase were to sustain without change for one year, the real level of change would be obvious.

Are you ready for a quick example?

Let’s say you had planned to attend Baseball spring training in Scottsdale, AZ for March 2021. You will stay 1 week. Then, in March 2022 you plan to do it again because you had so much fun. Everything will be the same for the trip, same airline, hotel, etc. and the inflation reported in the diagram above would stay steady for the whole year.

- The admission to the different training events and test games for the week (5 events) is $1000 total for you, your wife, and the two kids — a family package.

- You use the local transport option because that gets you right to the venue and no time is needed for parking. Total transportation cost for the family for 1 week = $50.

- You booked a nice suite in a local hotel that offers beds for each family member for a total of $600 for the week.

- You booked the flight on an online site like Priceline.com and paid $600 total for the family round trips.

- Total for these items (I know we did not account for food, gifts, trip from home to airport & back, etc.) = $2,250.00

For your 2022 trip when you add the inflation based on the diagram above, here is what would happen:

- Your admission would now cost 1480.00 (40.8% more)

- Your transportation would cost $85.00 (70% more)

- Your Hotel would cost about $1,235.00 (105.6% more)

- Your airline tickets would be about $1,350.00 (122% more)

- Total trip cost in 2022 = $ 4,150.00 — pretty much double from 2021 (1 year ago)

That’s what inflation that looks pretty elevated MOM really does if it stays at that level for a year.

Now, you might say: “Axel, we are reading what you write because we are interested in real estate investing and not baseball training camps in Arizona”.

I hear you and this is how it relates to our investments in real estate.

You have heard that prices have been going up a lot (about 12% on average last 12 months). That means there were places where it was even more and somewhere it was less. That nice for our appreciation for all the properties we already own.

Not so nice if we want to add to our portfolio and buy more. You might wonder if this is just the tip of a wave and prices will come down again sometime soon?

In an inflationary environment, we seem to be entering I think they will probably stay high and keep increasing. Here is why:

For prices to come down a few things would have to happen.

- Inventory would need to increase so there is plenty of supply for massively increased demand.

- For inventory to increase builders would need to build a lot more houses and apartments.

- For them to build more they would have to have easy access to money (which they currently don’t have because the banks are very strict with lending)

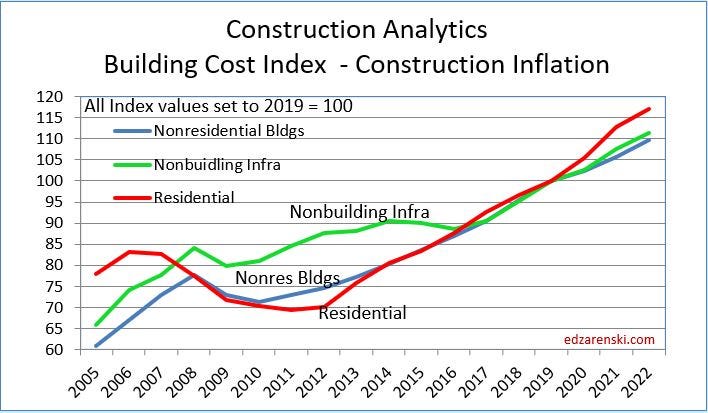

- For the houses, they building (assuming they get funding) the cost of construction materials would have to be stable or falling. (Try and take a look at the cost of wood at your local Home Depot or Lowes. You will be shocked what a single 2×4 costs and you know that most houses in the US are made out of wood).

5. Land would have to be available, permits easy to get, financing of construction loans easy, etc. None of that is the case.

6. Some way to get the backlog from the last 10 years resolved. (in case you didn’t know we had 600 thousand fewer homes built between 2011 and 2021 — fewer than needed to meet population growth. Now we are 6 million homes in the hole) That’s why there is so much demand and so little inventory.

One other important aspect of this overall picture is labor cost. Yes, we are just coming out of the pandemic, but it is already obvious that there will be shortages in labor. The reason is that people lost a lot of less qualification-heavy jobs and the market has a lot of demand for higher-qualified workers. While training and requalification programs are part of the suggested programs of the Biden administration, it will take time to educate a lot more people in new skills.

If you combine what we discussed about inflation with needs in the economy, you see signs of a labor shortage. Zachary Wolf in a recent CNN piece asked Anneken Tappe, the senior writer at CNN Business who covers the US economy, the question if it is true that companies need to find more people:

Why don’t companies raise wages?

WHAT MATTERS: The counter-argument is that workers in less desirable jobs are underpaid. I’m no economist, but couldn’t companies just pay workers a higher wage to bring them into the workforce?

TAPPE: That’s actually already happening. The reopening has spurred demand from consumers and many companies have a hard time keeping up with demand so they’re raising wages to attract workers. Under Armour Wednesday announced it will bump its US minimum wage from $10 to $15 an hour to compete in this confusing labor market, which means a pay rise for 90% of the company’s store and warehouse staff.

Amazon, Walmart, Costco, McDonald’s, Chipotle, and others have also increased certain wages.

Bank of America went a step further Tuesday and announced it would lift its minimum wage from $20 to $25 per hour.

So, as companies raise wages, they allow employees to pay for the higher prices that inflation generates. That is good for us as investors because it means we will also be able to increase the prices for our offering — the housing that these employees pay rent for.

If you followed my advice the last few years, you will have locked in low-interest rates for your properties already and the cost for property taxes is often capped by laws and not likely to rise a lot. That only leaves insurance as a factor that might increase on the expense side for you as an investor.

Summary outlook for us as investors:

- Mortgage and property taxes will remain stable

- Insurance cost might rise slightly

- The value of our properties keeps rising a lot because of low inventory and high demand

- Our rents will rise with inflation — leaving more of the money as passive income (positive cash flow) in our pockets each month.

- People don’t earn less when inflation goes back down, so these higher prices and rents will remain, allowing us to retain our income.

That all means the houses we own will be the boats that will float higher (in value and rent generation) as the inflation tide keeps rising.

For new purchases, we should still be ok as long as we follow the 1% rule and make sure that what we pay (even if that is a bunch more than we paid just 1–2 years ago for a similar property) and how much rent we can collet meets the rule.

Good times are ahead for passive income investors.