Why we don’t recommend investing in multi-family

Now that the new year has started you might have asked how and where to invest money, build a legacy, create a passive income portfolio, and ultimately reach what we call economic independence.

Economic independence is the point in time where your passive income from investments reaches a level that allows you to do what you love with the time you have and no longer need to exchange any significant part of your time for money.

To reach that point, you determine how much money needs to come in every month and then invest in such a way that this amount or more is dependably coming to your bank account.

When you ask me and my team, we have always recommended making those investments in single-family properties, houses that we would basically live in or move in ourselves if we had to.

Some people have asked me if it wouldn’t be faster to make those investments in multi-family properties. The answer is: “Yes, but they also bear more risk and much more headaches”. The main reason is that apartments are typically cheaper per unit than a single-family property.

The definition of a multi-family dwelling is a little different depending on who you ask. Most people mean apartment complexes that have 10 or 20 or 100 or even more units when they talk about multi-family dwellings. Other people mean a property that has more than 1 unit, like a duplex, triplex, or fourplex.

The US-government has made a distinction based on financing rules. You can finance a property that has anywhere between 1 unit (or door) up to 4 units/doors using the same rules as if you were to finance your own house. You can use government-insured loans, i.e. FHA, also known as Fannie and Freddie.

As soon as a property has 5 or more units or doors, it is considered commercial and falls under different rules. Those rules don’t just apply to the way these larger properties are financed but also apply when trying to determine how much they are worth, how to appraise them, how to calculate the value, etc.

To keep things simple you might, as an investor, say: “I’ll just keep it to between 1–4 units (or doors) to benefit from the government protection and rules I am familiar with.” That’s also what I recommend.

So with that out of the way, you will find that a fourplex in a well-performing investment region is typically cheaper, per unit, than a single-family house. It would not be uncommon to find a fourplex for $280k, meaning each unit in the building costs you $70k while small houses with 3 bedrooms, 2 baths, and about 1000 -1200 sq ft cost $100k — $150K, possibly up to twice as much as a fourplex unit.

There is a list of reasons why the fourplex is cheaper. Here are a few things in case you wonder: A fourplex typically has

- Common external walls

- Some shared internal walls

- Common roof

- Singe main water line connection from the street to the building

- Single main gas line, septic lines, etc. to the distribution box or meter at the house

- No individual gardens for each unit

- Rarely individual garage for each unit

- Common waste line to city septic systems,

- Smaller overall property size

In many ways, living in an apartment or multi-family property used to be a stepping stone for many people and families on their path towards a house, either as a tenant or owner.

The pandemic of 2020 has accelerated this process.

To maintain sterility for door knobs, railings, stairs, and common areas in general it is much easier if you live in a single-family house than in an apartment complex. That’s especially true if you consider a large complex with elevators. How do you practice social distancing in an elevator?

On top of that you have to deal with issues like parking, noise from the neighbors, HOA fees, and much more.

One of the attractors of apartments used to be the proximity to work and most times the fact that apartments are typically cheaper per sq. ft. than a house.

Now that people can work from home and no longer have to be close to work, the freedom to look for a house a little further away from city centers has grown significantly.

That’s a great benefit for investors.

You get higher rent for a house. On top of that, a good quality property is much more likely seen as a home than a temporary living space. That means the tenants will stay in the house longer than they typically would in a fourplex or apartment.

As the owner or investor you don’t have to deal with conflicts and fights about noise, cleaning the sidewalk, trash in the hallways, etc.

And then there is one more really important aspect that has to do with one of my biggest points about single-family real estate investing — cash flow!

That goes back to the whole reason to invest in residential real estate to begin with. We want to get cash flow so we can reach economic independence sooner rather than later.

In most cases, any property management company will charge you about the equivalent of 1 month’s rent to go through the process of advertising, marketing, vetting services to find a new tenant for your property when an existing tenant leaves.

Think about what that means. Renters actually want to be in their own home or a single family property if given the choice. They don’t really like to live in an apartment very much as this research shows.

Here is an example:

You have a single-family house that pays you $1000/month in rent and after all costs and reserves are paid, you have $200 cash flow each month. That’s $2400/year.

Tenants who see the house you provide to them as their home on average stay for 4 years.

If you compare to apartment complexes, a recent article by REI Nation shows that tenants on average stay for only 1 year. Let’s say the rent for the apartment is 20% less than your house, or $800/month. Let’s further assume that you also make $200/month in cash flow because the apartment or Fourplex was cheaper to purchase and therefore you have less cost/expenses.

In the four years you have the house rented you make a total of $9200 and then have to give your property management company $1000 to find you a new tenant, reducing your overall cash flow to $8200.

In the four years that you have your tenants in the apartment or fourplex, you will have 4 turnovers and had to pay management $3200. That means you will really only earned $6000 total or $2200 less than the house.

Maybe you might say that’s not really that bad, but think about it in the context of your overall goal of not needing to go to work and exchange time for money anymore.

How does that play out when you assume that you need to have $20,000 to keep buying $100K houses and $70,000 to keep adding more apartments to your portfolio?

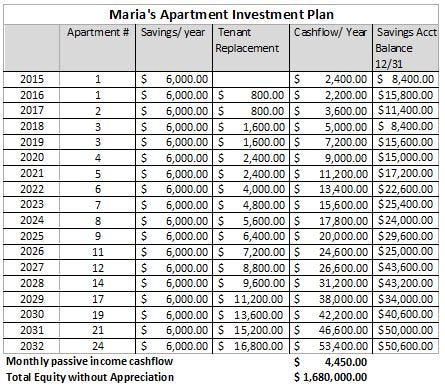

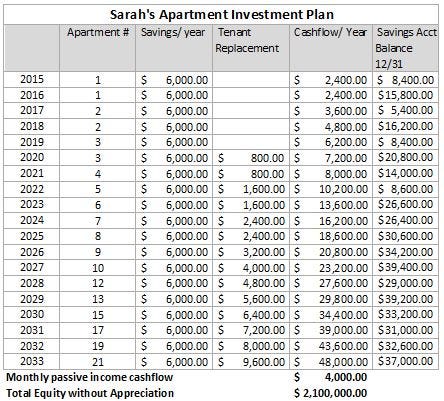

This could be a pretty complex calculation but to make it easy, let’s assume we have Sarah who puts $500/month into a saving account so she can keep buying more single-family houses. Maria also saves $500/month, but she prefers to buy apartments. Both our heroines commit to add all the positive cash flow they get from their properties into the savings account to be able to reach economic independence faster. They both determined that they will need about $4000/month in passive income to quit their jobs. They both started investing in January 2015 when they turned 30 years of age. We assume that each time a tenant leaves there are no significant repairs needed to the apartment or house. We leave inflation and increases in rent, value of the apartments or houses etc. out of this example to keep it simple.

- Sarah had saved $20K by the end of 2014 and bought a house for $100K that pays here $1000/monthly rent and she has $200 cash flow to her savings account. Maria had $14k by the end of 2014 and bought the $70K apartment that brings her $800/month rent and also $200/month in cash flow.

- By the end of 2015, both Sarah and Maria saved $6000 from their income and $2400 from cash flow for a total balance of $8400.

- Maria was told that her tenant had given notice and moved out over Christmas. Maria paid her property management company to find a new tenant who moved in on Feb 1st. She had to use $600 from her savings account to cover all the expenses that normally would be covered by rent and she did not get cash flow for Jan 2016.

- By the end of 2016, Sarah had a balance of $16,800 in her savings account. Maria on the other hand only had $15,000 due to the cost of getting a new tenant. That new tenant had given notice in Dec 2016 and moved out after Christmas. Maria had to give $800 again to the property management company to find a new tenant and cover the rent for January from her savings account.

- The balance in Maria’s savings account had recovered to $14,200 by 1 May 2017 and she bought another apartment, again for $70K. 2 month later, on Jul 1st, 2017 Sarah had $20,000 in her account and bough another $100k house with $1000/month rent.

Here are who the two plans come out over the years:

As you can see from the tables above, Maria will actually reach her goal in 2032 at age 48. Sarah needs 1 year longer and will be there in 2033.

While Maria gets a little more income each month and the end of the plan, she has about $1/2 million less in equity, assuming the value of each house and apartment never increases above $100K and $70K, respectively.

For anybody familiar with the actual development of real estate, you will be right to assume that you would increase rents over time, which would allow you to buy the houses or apartments faster. On the other hand, the properties will also increase in value and cost over time and what you could buy with $4000/month now would not be the same in 15+ year from now.

The main point is this. Maria has way more turnover in apartments and it takes therefore more apartments (24) to reach her economic independence goal. I only allowed 1 month to replace a tenant in both calculation, but it could easily take longer than that. Because apartments are cheaper, Maria can also buy them faster as long as she finds a way to make as much cash flow as Sarah buying house.

On the flip side Sarah has substantially more equity in her properties, her tenants stay much longer and it would be much easier to borrow against the equity in the houses. In addition, Sarah has the benefit of government protection in case our financial system ever gets into trouble, which is not that far-fetched when you look at the increasingly insane amounts of debts we keep accumulating.

You can reach economic independence either way in a reasonable amount of time. Sarah’s approach is a little less risky and leads to more equity. Maria’s is more stressful and has more risk factors but leads to a similar result, potentially a little sooner.

In either case, now that you start into 2021, set your own economic independence goal and then start investing.