No more seats for interested investors?

A few days ago a friend from Germany who had seen what we do with our Out of State Turnkey Single Family Residential (OOS TK SFR) investment strategy contacted me with a WhatsApp message asking:

“Is it already too late?”

He added these two pictures:

Let’s start the story at the beginning:

As some of my readers here on Medium, audiences listening to real estate investment podcasts, or followers and subscribers of our YouTube channel know for the last 2 years, we have been helping people who want to generate passive income to create a portfolio of residential real estate holdings that will allow them to reach their Time Freedom Point.

Just as a quick reminder, the TFP is the date on the calendar where the passive income you get out of your properties meets or exceeds the expenses you have every month to live your life. After that date, you have the freedom to decide what you want to do with your time. That means you can keep doing your job, or cut it in half or quit. You can start doing things that you always denied yourself because you needed to exchange time for money and had none left for your passions.

This is all working well for people who are US citizens or permanent residents because the government and all the lenders, banks, title companies, etc. see them as their traditional customers.

When some of the readers, viewers or listeners from Medium, YouTube and a number of podcasts reached out and told me they were interested but are not in the United States and aren’t citizens, I used to tell them that typical lenders would not give them a good deal.

Not a good deal meant:

- You could buy property cash only and have no leverage

- You could put a 50% down payment on an investment property

- You could get a large umbrella loan or line of credit to draw your money for purchases but that line would be double the normal interest rate and only last for 10 years and could only cover 50% of any individual investment.

For an investor who wants to use leverage and build a portfolio without having a ton of money from the start, none of these options were appealing.

That’s why I used to tell the folks who contacted me that I did not really have a good path I could recommend to them.

This bugged me so I started to ask around. I finally discussed the issue with my turnkey providers and one pointed me to a broker who used to be able to get financing for foreign nationals.

That sounded great. I got in touch, we talked and she told me that the pandemic had made lenders extra-cautious and no programs were active. That was at the end of 2020.

Then in February she called me out of the blue and told me that she had gotten permission to restart one of her favorite programs and if I would be willing to get started in our loose partnership that aims to help people from other parts of the world to invest here in America.

I was and I contacted my friend in Germany. He had indicated that he has a bunch of folks in his network who had seen the developments in America but all assumed they could not participate. If we could find a way for him there would probably be a number of people who would want to replicate the approach.

I told him that there was no guarantee that we would ultimately be able to make it work because the lending is only one part. There are issues like:

- What address is supposed to go on all the forms and documents?

- How can we create a company that will purchase the property and hold the title without citizenship or permanent residency?

- Who will sign as a witness when we can’t meet in person to verify the identities of the investor?

- How do we get an employee identification number for a foreign person

- How long will the release of funds take assuming qualification has been completed?

- Will a turnkey provide wait for us in light of the fact that they have all kinds of investors and buyers knocking on their doors?

- Will the transfer of funds for the down payment and any other fees from a foreign bank go through without a hitch?

- How can we establish a bank account for the new company that will hold the investment when we can’t meet in a bank?

- Other stuff we haven’t identified yet that could still destroy the deal

My friend basically agreed to be a guinea pig knowing that the first go-around would not be easy or fast. I am blessed to say that he was ok with it — so far.

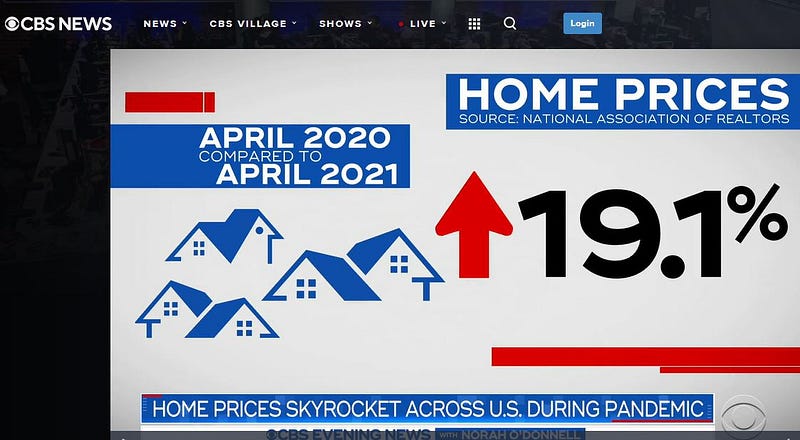

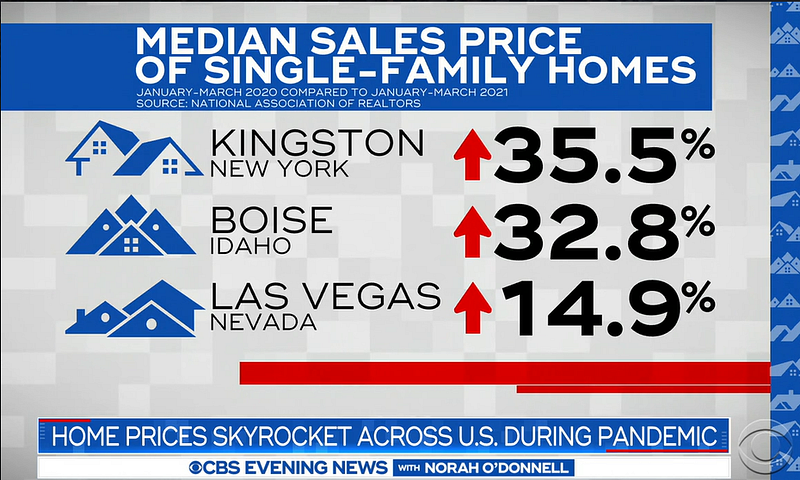

When he saw the evening news on an international channel he understandably started to be worried.

In case you had been holding your breath so far to learn what I responded, you can exhale now.

I told him what I tell all my other clients, US or foreign:

“We are purchasing properties for performance, not for appreciation!”

Yes, it was easier in 2019 to find a $95k house in the Midwest and rent it for $950/month by the property management department of the turnkey provider we work with. Now that same house might cost us $115K. Can we find a nice family with a good stable income to rent our 3 bedroom/2 bathroom house that was just renovated and smells like new for $1150/month in rent — I believe so.

Yes, prices have kept increasing and due to the severe shortage of houses on the market, will probably keep rising.

For us and our goal to generate passive income in the form of positive cash flow from our well-performing properties, not much has changed, except the numbers might have increased. And yes, well-performing deals are harder to find. That’s why the relationship with the turnkey providers is so important.

If you playing the musical chairs game of appreciation, there are still a few seats left, but nobody knows exactly when the peak will be reached and at someday in the future, all the chairs will be occupied.

We are playing our game — the one for passive income/cash flow based on performance — and that is still in the early stages and plenty of chairs available.

I could actually argue that the post-pandemic environment has added a few chairs to our game. As you probably heard by now, something that has been missing from the picture has returned. Yes, I am talking about inflation. That’s a group of chairs that we had taken out of the circle and put into the attic. Everybody had told us that those wouldn’t be needed anymore in a modern society of unlimited money printing.

Now they are back and keep getting more numerous. It’s a good thing for us. When inflation started showing up and things are getting more and more expensive, guess, what — rents go up as well. At some point in a few years, even interest rates might go up a little.

We benefit because our costs for a mortgage, insurance and taxes are pretty much locked in. When rent levels increase, we all benefit. That also means we retain the value of our properties. The prices of the homes will keep increasing and the rents are increasing as well. The only thing that will remain pretty stable is our costs.

The music hasn’t stopped by any means and there are still chairs, some even newly dusted off.

Don’t pay too much attention to the appreciation of properties and spend your time looking for performance. As long as we can find well-performing properties in the markets we like, our game will keep going, and the music won’t stop.