Predictions from industry experts and myself

I have been a regular subscriber and follower of a video-podcast called “Our Ludicrous Future” that started 3 years ago. Three people from three different fields came together each week to discuss what has happened in the world of high tech, science, and space. I liked the banter and often the info that as shared was interesting, especially because each presenter is an expert in his field while the other two are not very informed. That led to questions all typical viewers would ask (including me).

Last Friday the trio, somewhat surprisingly, announced that they had decided to end the show. The main reason was scheduling difficulties that already resulted in several shows not happening to only having two presenters.

What was really interesting at the very end of this last show was the question each of the presenters was asked to answer — or I should probably say predict?

Joe, Tim, and Ben were challenged to predict how they see the future in their field of expertise and each shared some very interesting ideas.

That triggered me to ask myself how would I answer or what would industry experts say when asked a similar question.

To start, so you can get a perspective of some of the more relevant aspects that come into consideration, I want to remind you and raise awareness of the things that cost money when you have bought real estate.

Yes, there are a few variations that apply depending on whether you buy to live in the property yourself or as a passive income investment, but most things apply in either case.

Here are the main things to take into consideration that are summarized under closing costs:

- Application fee

- Appraisal fee

- Credit check fee

- Origination and/or underwriting fees

- Title insurance

- Title search fee

- Transfer tax (if applicable)

The total of these items together is about 2–5% of your mortgage loan amount.

You need to add your down payment (because that is a cost to you.)

There might also be property taxes depending on when in the year you buy and how much the previous owner had already paid.

There might be HOA (Home Owners Association) fees to consider, and depending on how high your down payment is, you might also have to pay for mortgage insurance.

It’s a lot of stuff and if you thought you are worse off than the seller, don’t forget that the seller still needs to pay the real estate agent or broker, which can also be 3–6% of the sales prices.

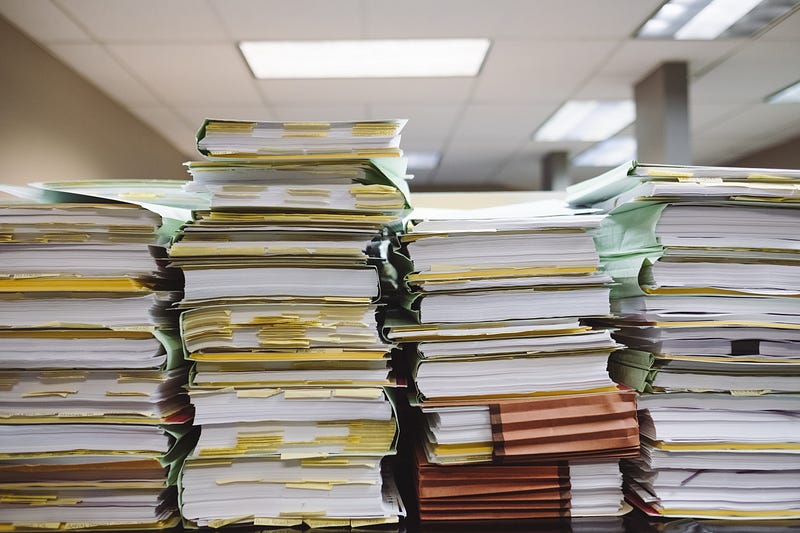

Overall, the system of buying and selling real estate is pretty antiquated. You can quickly see that when you look at the pile of paperwork, you have to sign when finally closing the deal.

What do experts say will change in the next 1–5 or 10 years? (most statements were made in 2019 and 2020)

Glenn Orgin, founder of Richr

“Currently, selling homes is very expensive. This expense is driving a trend toward more automation for increased efficiencies. The future of real estate is all about transaction automation to enable buyers and sellers to seamlessly transact on their desired home purchase using one platform.”

Luke Babich, CSO at Clever

“Information about homes has become more accessible than ever before. Sales history, home details, and pricing information are all available online to the public, dramatically reducing the friction and costs in the home buying process.

As the costs and barriers to *finding* a home fall, other costs in the process become a bigger problem. Now, the transaction costs of selling a home are a bigger expense. The process of getting a home ready for sale, pricing it correctly, and finding reliable professionals is still inefficient and expensive: it’s the next frontier for the real estate industry.”

Adam Hooper, co-founder and CEO of RealCrowd

“Real estate as an industry has always been slow to adopt technology, but this is rapidly shifting and the pendulum is swinging heavily towards quickening adoption. Everything from efficiencies in property and building management, the capital markets, sales processes to blockchain is now on the table. Driving this shift is the rise of younger, more tech-savvy executives that are coming into positions of leadership and bringing with them a much more open view into how technology will disrupt the industry.”

Avi Sinai, Owner of HM Capital

“The future of real estate finance is private. Even with a booming real estate market — it’s hard to get a loan. Banks are too slow to adapt to trends in real estate. Ask how many bankers will lend on a second house with AirBnB income — the answer is not many.

Peer-to-peer lending is the future of real estate — where parties agree to terms and borrowers are unchained from old barriers of ‘credit scores’ and past mistakes. It will bring more buyers into the market and allow investors with cash to put it to work, earning good passive income.”

Dominique Burgauer, CEO of Archilogic

“Almost every stage of a building’s life cycle will be managed online. From construction and furnishing to sales and maintenance, the real estate industry will be online.

The highly-discussed concept of ‘digital twins’ will not appear overnight, but we can already see that a new standard is forming from the adoption of data-led tools by leading innovative companies. We are moving to a point where there will be a single source of truth on each building powering spatial decision-making across the value chain. Tomorrow’s stakeholders will not tolerate the industry as it is today. Companies will need to push their services online or be punished by the growing number of millennials entering the market.”

Ryan King, Agent at Nourmand & Associates

“I think the future of real estate is brokerages partnering with escrow companies. People are finding homes and viewing homes more than ever without help from realtors. They’re even becoming smarter about comps and what amounts to offer. The value of real estate agents (which can’t be done by a computer) is the problem solving in escrow and the relationships they have with other realtors. How to handle mold remediation, how to convince a seller to extend contingency periods or how to convince a seller to give a credit just to name a few.”

James McGrath, co-founder of Yoreevo

“The big, broad change I see in real estate over the next 5–10 years is dramatically higher efficiency. Buying or selling a home is still pretty much the same as it was decades earlier and that’s because it’s still run by individual agents who have small operations and therefore don’t have the potential return to justify significant investments to increase efficiency and profitability. As companies start to run the process, rather than agents, we’re going to and already starting to see that change.

Zach Lombardi, Principal of the Aranson Lombardi Team at Compass

“There is a strong movement inclusive of Millennials to Baby Boomers who are actively viewing real estate as a smart investment; interest has steadily increased from these demographics over recent years. Home ownership is on the rise in many cities and the on-going trend is families and single people alike, purchasing smaller homes closer to cities and public transportation that are more affordable and easier to maintain. With continued historically low interest rates and healthy price corrections, at a micro-level, we see home values continuing to appreciate.”

Than Merrill, Real Estate Investor and CEO of FortuneBuilders

“New Tech: The future of the real estate industry will be largely impacted by current developments in technology. In particular, the emergence and growing popularity of cryptocurrency and blockchain will greatly impact transaction times. Typically, real estate deals have a closing period no shorter than one month. However, with increased access to blockchain networks, buyers and sellers will be able to negotiate and sign contracts faster and with greater ease than ever before.”

Daniela Andreevska, Marketing Director at Real Estate Data Analytics Firm Mashvisor

“The future of the real estate industry lies within big data, predictive analytics, AI, and machine learning. With the advance of high tech, tech real estate companies will make more and more use of these to automate all process related to the industry such as searching for properties for sale, analyzing real estate deals, and even buying and selling a property.”

Mark Armstrong, CEO of RateMyAgent

“I think as a result of new technologies and business models we will start to see the market split into two distinctive groups divided by price points. The lower end will be dominated by new technologies and business models such as iBuyer, self sell, and low-cost agents. Technology such as virtual tours that assist in low touch from agents and a high level of automation will become more prevalent.

At the higher end of the market, demand for good real estate agents will intensify. Sellers of expensive property demand a higher level of service. Transparency around agent experience and customer satisfaction will drive agent selection. It is unlikely that technology will ever reduce the need for a good negotiator at the top end of the market.”

What do I think we will see?

I agree with all the experts who point to technology and improvement of the customer experience.

I believe that people will become more and more aware that there are cheaper solutions for different services. It has been customary that the fee for a transaction is a percentage of the purchase price.

In 1997, I became good friends with the owner of a Coldwell Banker brokerage in New Mexico. The company sold about 100 properties per year. The fees were between 4–6%. The average sales price at the time was around $100K.

A few years later, after retiring from the Air Force my family moved to Santa Barbara County, California. The average sales price in that area was about $700K at the time. The fees were the same 4–6%.

That meant that a broker or agent in New Mexico had to sell 7x as many houses as the same agent in Santa Barbara to earn the same amount of money in commissions.

Did the guys in Santa Barbara really work 7x as hard? No, they didn’t but the promise of quick money — basically “sell 1–2 houses/year and have enough money to live” resulted in more than 1000 registered agents in the area.

The bottom line is, that aspect of the cost calculated as a percentage will go away and be replaced by technology solutions.

Similar to car buying, people will do all the research online and know everything there is to know about a property before they ever engage any person about buying it.

Will there be agents as we know them today? Maybe.

All the things that can be done to automate the process, digitize it, and conduct research will probably move to digital platforms.

Ultimately, people will be better informed and make better decisions for the purchase.

The paperwork will probably get reduced because it will move online.

The houses that will have the best chance to be sold at a good price (from the seller’s perspective) will be those that are environmentally friendly, modern, and equipped with high-speed internet, solar solutions, great insulation values, and all kinds of other security and energy-saving technology.

I wouldn’t be surprised if we will come to see a house as much more than a place to sleep. We will work from that house, generate the energy we consume on the roof of that house, heat the water we need warm with solar heaters on the house, will generate our own drinking water on the roof of that house, have high-speed satellite internet using Starlink, have all kinds of communication and security systems to communicate and protect us.

Our future home will be more the hub of all our activities and if we have a little bit of a garden, I would not be surprised if more and more people will collect the rainwater and grow some fruit and veggies around that house.

The house as a technology and eco-friendly hub will allow us to express ourselves and develop the freedoms many of us currently miss.

Let’s check-in in 1–5–10 years and see how much of what the experts and I predict will have come true.

What do you think the future of real estate will hold?