Re-evaluating generational divisions and what that means for the future

Have you ever been in a situation where you ran through life, read things, reviewed things, heard stories, etc., and always associated yourself with a certain group. Then with the study of a topic, you realize that the association could be slightly off, putting you in a different group and therefore having a totally different impact long term.

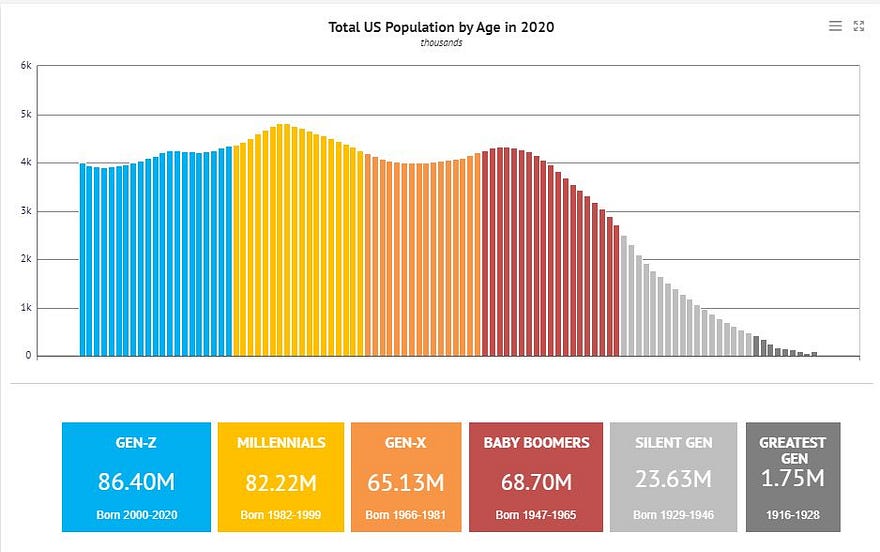

Take a look at the graphic below and see the probably pretty familiar delineation of the generations currently living in the western world.

Based on that depiction I was sure I am a Boomer and always have been.

Then I started studying some of the economics and investing data and writings to try to learn how the next few years would probably develop, especially in light of the ever-increasing money printing by the national banks in Japan, America, and Europe.

When I googled what experts suggest, I came across a book called: “The Greatest Chance of all Time” by Marc Friedrich.

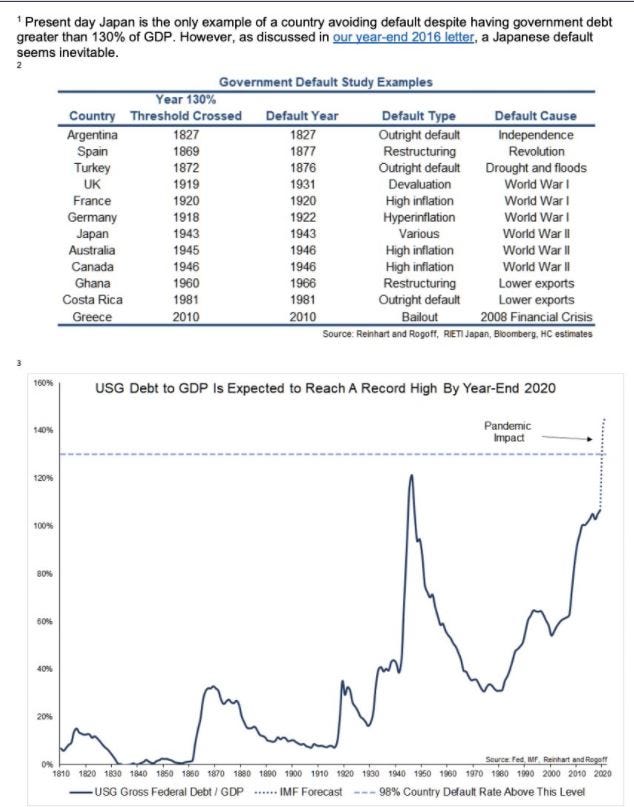

In it, he speaks about the ever-increasing national debt in the US and Europe, the need to consider value investments, like Gold, Silver, real estate, etc. One really interesting figure he pointed towards was this:

In the history of economic data, it has always been an indicator of ultimate failure when the ratio of debt to GDP reached 130% or more. Actually, 51 out of 52 countries defaulted one way or the other when that happened. The only one that hasn’t so far is Japan. The US reached 130% in 2021.

So I thought I was part of the boomers and we are steadily working towards a cliff. Then I heard about the book and read: “The Fourth Turning” by Neil Howe and William Strauss.

They had done a ton of research about the way people in general — all of us, “tick”. How are we influenced by the time we were born, how we were raised, what our parents felt when they were in their prime and how that impacted our own behaviors.

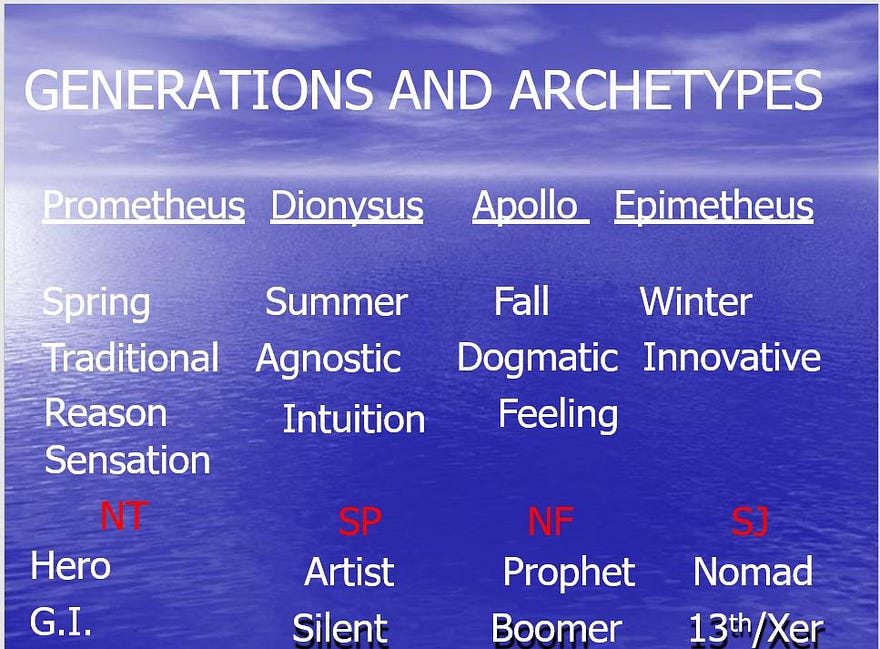

I was intrigued to see and read and re-learn that there were connections between the archetypes that Carl Jung had described and I was forced to learn about during my Ph.D. studies. And again in my work with companies where I help to develop better managers and leaders, I frequently use personality style tools like MBTI (Myers Briggs Type Indicator), the DISC Assessment, or the HRDQ Leadership Style Assessment. They all identify how people are different and can be categorized into types.

That correlation made sense to me. You can see in the image below with the red markers showing the styles from these assessments correlating to the groupings of the Fourth Turning.

Ok, so they called me a Prophet — no big deal.

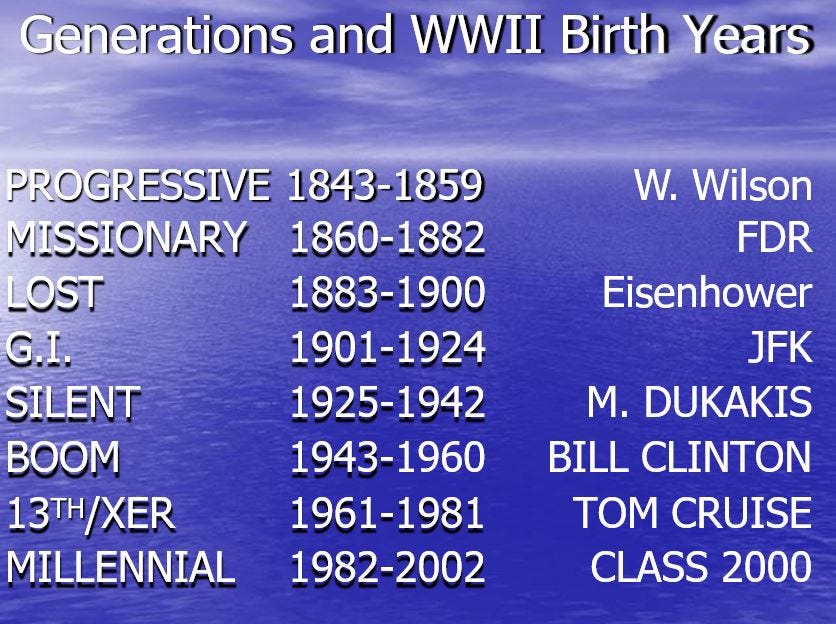

As I dug deeper to learn what all this would mean for our future: The authors divided the generations of the US population and their impact on how things are handled. Here is what that looks like:

Can you see that slight difference from the other graphic above? By determining that the Boomers are born between 1943 and 1960 and the 13th generation of Americans — also known as X-ers started in 1961 — when I was born — I suddenly belong to a new group.

I can live with that but I want you to realize and maybe encourage you to also take a closer look at the cycles of life, the cycles in our economies, and how things correlate.

They are like seasons of the year and we are now in winter.

These cycles are not new by any means but have been around and recognized for thousands of years. They last about 80–100 years and within that timeframe, we have the 4 seasons each lasting about 20–25 years.

Our current cycle started around the time of the Great Depression. World War I was over, everybody thought we could just celebrate but financial systems were already stretched to the limit and in 1929 we saw the great crash followed by the great depression.

Everything needed to change and it did and that is what Spring describes. New growth emerges and new systems take hold. In summer they keep growing and in fall it’s time to harvest. Then comes winter allowing us to regenerate and try something new. Each season has triggers that indicate the shift from one to the other.

The trigger or indicator that started the winter we are in was the financial crisis of 2008. If we give it about 20–25 years, we will be done with this period by the end of the decade.

By now you might ask: “Why are you writing this for us?”

I want you to learn about these cycles, seasons, and styles that make us who we are.

More importantly, it is very clear and always has been true through the millennia, that the way to get through winter and start spring in a good state of health, finances, and positive outlook is the preservation of value.

I would like to ask you to find out what holds value no matter what? We are suggesting residential real estate investments so you can become an ideal wealth grower and reach your time freedom point. Real estate will always have value because it provides an elemental need for people — shelter!

Reading these books and studying the topic also sensitized me to look at other stores or values, like Gold, Silver, raw materials we will need to supply our future economy, like Lithium, Platinum, Uranium, etc.

Some people also add collectible art, rare watches, wine, etc. into that group.

What doesn’t hold value is the colorful paper the federal bank print to make you believe it’s worth 20 Dollars, or Euros or Pesos. If they were careful with it and it would be as rare as the other stores of value, we wouldn’t have to worry. Instead, they keep printing more and more paper and now digital money without any value behind it. That’s not sustainable.

As a 13teener I am considered part of the cohort intended to guide those entering the prime of their economic and family life. My guidance is to learn and then look towards stores of value so you can get through the bad parts of the winter that we will see in the next 8 years.

We can see the first sign with rapidly increasing inflation, ever-larger government programs to prop up the economy, and debt levels that quickly will go above the point of no return at 130%.

Boomer or 13teener — it’s important to be educated and prepared. If you look into history those who weren’t equipped typically got washed away and had to suffer. I want you to avoid that for yourself and your family.