It works best when you start very early and never stop

In recent news, NBC published the results of a new survey. They found:

Large majorities say the U.S. is going in the wrong direction, that they are falling behind economically and that political polarization will continue. Overwhelming majorities of Americans believe the country is headed in the wrong direction, that their household income is falling behind the cost of living, that political polarization will only continue and that there’s a real threat to the nation’s democracy and majority rule.

Why do people feel that they are falling behind economically?

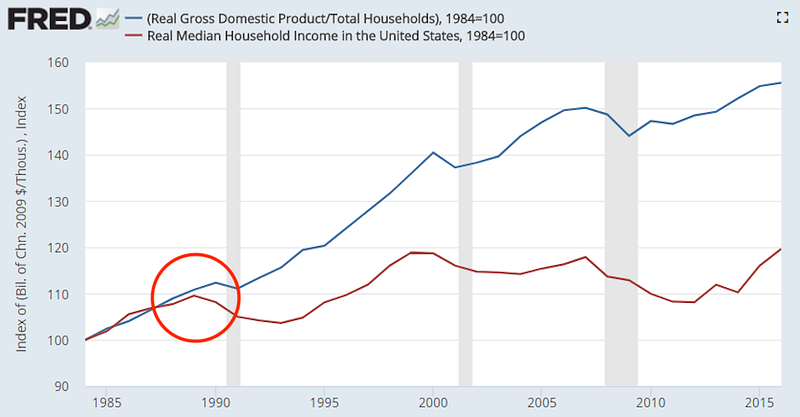

A fellow author here on Medium, Umair Hague provided an important part of the answer in his article and the image below.

In the United States around 1990, the median household income and the GDP started to diverge.

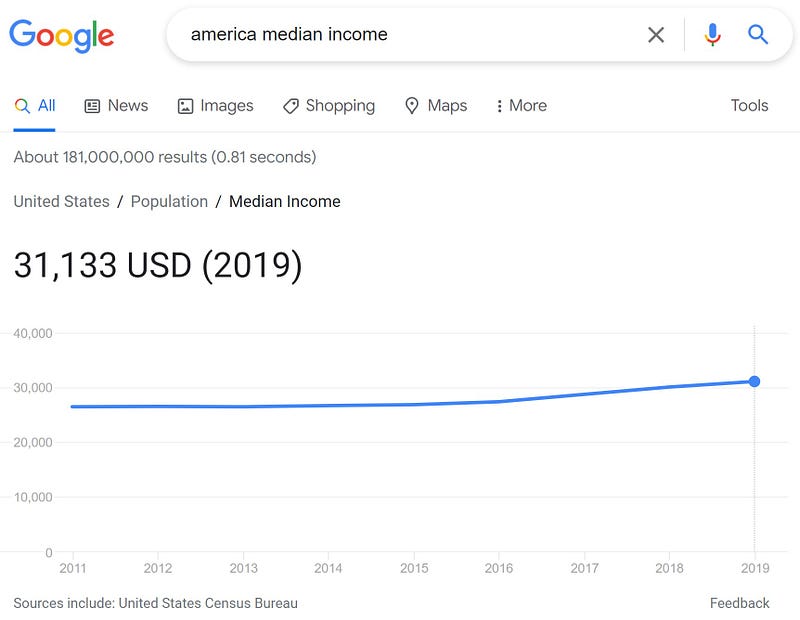

You might wonder what the number actually is, as was I. Here is what I found when putting American Median Income into Google. I tried to find newer data but 2019 was the latest Google displayed.

If you were to ask people if they are part of that median line, you will find that about 75% of respondents in surveys say that they think they are above average.

Even though there are too many single-parent households, let’s assume there are two people to take care of the kids. So, what’s available for the average household to do so? I checked the US Census Bureau and here is what I found:

Highlights

Median household income was $67,521 in 2020, a decrease of 2.9 percent from the 2019 median of $69,560 (Figure 1 and Table A-1). This is the first statistically significant decline in median household income since 2011.

The 2020 real median incomes of family households and nonfamily households decreased 3.2 percent and 3.1 percent from their respective 2019 estimates (Figure 1 and Table A-1).

The 2020 real median household incomes of non-Hispanic Whites, Asians, and Hispanics decreased from their 2019 medians, while the changes for Black households was not statistically different (Figure 1 and Table A-1).

In 2020, real median household incomes decreased 3.2 percent in the Midwest and 2.3 percent in the South and the West from their 2019 medians. The change for the Northeast was not statistically significant (Figure 1 and Table A-1).

OK, so the average household makes about 2x as much as the median individual — makes sense.

To make that household income the adults of the household will have to work, which means the underage kids need to be taken care of somehow. It used to be that the kids spend most of their time in school.

Well, the last two years that wasn’t a sure thing anymore. How about childcare?

How much does childcare cost?

Based on the 2021 Cost of Care Survey, child care is not in the affordable range for most families. Of parents surveyed, 85% say they are spending 10% or more of their household income on child care. And according to the U.S. Department of Health and Human Services (HHS), child care is considered affordable when it costs families no more than 7% of their household income.

The survey also finds that more than half of families (57%) spent over $10,000 on child care in 2020, and 59% planned to spend more than $10,000 in 2021, which is more than the average annual cost of in-state college tuition ($9,580) per EducationData.org.

If you really think about it: People struggle to make ends meet and typically live paycheck to paycheck. Now you add childcare costs and realize that your part of participation in the GDP is getting smaller and smaller. On top of that, you have 7% official inflation and probably closer to 10% real inflation on the things you need to live on a regular basis.

What can be done to offer a better life to your kids and have more time to spend with them, rather than just moving them around from bedroom to school to childcare to bed at night?

The first thing is to start early when you are still on your own and don’t need to consider any expenses for your spouse or family. At that point put at least 10%, better 15% of everything you earn into an accumulation account and start purchasing residential real estate that is cash flow positive.

When you have found a partner you would want to start a family with, both put 10% — 15% of everything you earn into an accumulation account to keep buying residential real estate that is cash flow positive.

What would be the impact? Let’s say you make a little more than median income = $36,000/year and put 15% aside, that’s $5,400/year. Let’s say you do that starting at 25 years old for 4 years. That’s a total of $21,600 and you bought your first cash-flowing property.

Then you hook up with your future spouse and you both do the same thing for 2 more years and buy your second property together.

You are now 31 years old, get married, and soon have your first child. You are both making a little more income and still put about $6,000/year aside plus the income from your two properties. These both generate $250/month in positive cash flow or $6,000/year. Total accumulation/year is now $12,000.

On the first birthday of your child, you buy property #3. With $750 cash flow per month, you can afford great childcare and keep investing as before.

By the time you hit 40 you and your wife will probably own 7 or 8 properties and you will start thinking about one of you no longer having to work.

By the time you turn 45 or 46, you will have more than 10 properties and can really take care of your kids and your family.

As you can see, there is a path to avoid the dilemma a lot of families face these days if you start as early as possible and be disciplined.

We call this path the Ideal Investor Journey that leads you to the Time Freedom Point where you both no longer have to exchange your time for money but can start living your passion and take care of your children.

If you like help getting on that path, we are happy to help you with our mentoring program and customized personal support.