How to be in charge and make your money work multiple jobs for you

I recently had a great interview for our podcast, The Ideal Investor Show, and the conversation turned towards what we learned about money when we grew up.

Here is a list of the things most of you probably recall or practice right now:

- Put money in the bank and save

- The more and better you work, the more money you will make

- Get a good job so you can make good money

- It takes money to make money

- “Your greatest asset is your paycheck.” — ( Dave Ramsey)

- “Fun can be bought with money, but happiness cannot.”

- If you want stuff, you need to work hard so you can afford it.

- “Don’t buy things you can’t afford, with money you don’t have, to impress people you don’t like.” — (Dave Ramsey)

- “You earn what you deserve”

None of these and thousands of other statements indicate how you could make money work for you rather than you working for money.

Does that mean it does not work or exist?

No, that’s not what you should conclude. It’s just not advertised a lot.

How do you become the BOSS of your own money?

Well, think about what a bank does!

First people come and open an account and in the paperwork (that nobody reads) you sign that the money you bring to the bank and deposit into this new account is a loan to the bank. The bank can do with that loan what it wants and pays you interest for it.

Right now the interest you receive on a checking or savings account is about 0.1%. If you deposit $1,000.00 at that rate, it will grow to $1,104.01 in 99 years. So much for the benefits of compound interest that your parents were telling you about when you were little.

They did not lie to you. At the time interest on a checking account was 3–4% so your $1000 doubled to $2000 in 20 years. That was still not a great performance but it was something.

Back to the bank.

The bank will use your $1,000.00 and the same from 750 (or more) other customers and bundle it together to create loans.

Let’s say they create three buckets:

- Bucket is for mortgages — they put $250,000.00 into a mortgage of a customer and use a contract with 3% interest. That’s 30x more interest than you get in your checking account.

- Bucket is for car loans — the bank finances 8 cars for customers @ $30,000.00 each and an interest rate of 4.99%. That’s 50x ore interest than you get in your checking account

- They issue credit cards to 250 customers each with $1,000.00 credit line on the card. The interest rate is 18%. That’s 180x more interest than you get in your checking account.

Do you see where that’s going?

Adding insult to injury, here is what’s even crazier:

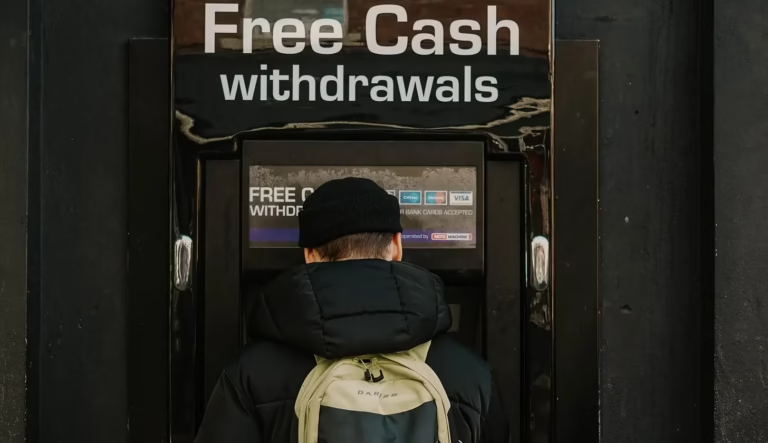

Let’s say you find a sweet deal on a motorcycle. It costs $6,000.00 and is in great shape. You want it but the seller only sells it for cash because he is desperate to pay off his credit card debt.

You go to the ATM of your bank and put in $6,000.00. Guess what, you will only get $300 or $400 per day. You would have to do that 15x to 20x to get the total $6,000.00— crazy. That’s because it’s not really your money in the bank account. It’s was a loan to the bank and when you created the account you signed that they only need to keep a reasonable portion of your money on hand. What is reasonable? — whatever they put in the contract.

Because you are smart you decide not to use the ATM and just walk into the bank itself and ask the teller for the $6,000.00 all at once.

First, they don’t have to give that to you if they declare that it’s unreasonable. Most of the time they won’t tell you in that way. They will just claim that they don’t have that much cash available, and offer you a smaller amount, making it look like they helped you out.

Ask yourself: “who is the boss in that scenario?”

So how can you be the boss of your money?

Here is one way to do it:

- Start an insurance policy with a non-publicly traded, privately-held insurance company. It’s called a “whole” policy. That means your premium payments provide you with the right for your beneficiaries to receive money in case you die. That’s a small portion of your monthly payment. The majority goes into an investment account. The company has to follow government rules and your contact will show the minimum interest you receive on your money. In addition, if the company uses all the investment money the policyholders put in each month, they generate additional investment profits that are distributed to your account. You get an annual statement that shows you exactly how well all the investments performed. This is Job #1 for your money — the money you take out of your income to pay the policy each month. By law, these companies can only invest in mainly safe investments like government bonds, etc. You can expect to get a performance of 4–9% annually on your money. Remember from above that that means your money will double in 20 years or less and keeps growing the longer you leave it in the account.

- Here is how you become the boss: The people that manage the insurance company make investments for you to increase the value of what’s in your account. In addition, you are secured by the policy coverage, let’s say $500K, or $1 million. Now you can ask the insurance company to pay out what is already in your account as a loan — very similar to a HELOC (Home Equity Line of Credit). You can use that money for anything you like. Because this money is only a loan, what you have in your insurance account plus all the payments you make going forward remain there and keep compounding because you have a deal where these insurance company investment experts work for you. The loan money is tax free.

- As the boss, you take the money you just received as a policy loan and turn it into a down payment for your next property purchases. Here is an example. Let’s say you accumulated $60,000.00 in your insurance account in 5 years. (That’s exactly what I did). With that money, you can now buy 2 residential properties, valued @ $150,000.00 each. That means you are the boss of the money and you now own real estate worth $300,000.00.

- These two properties, just to make the example easy, provide you with $500 cash flow each, per month, after you paid the mortgage and other expenses. That’s a property that gets $1,500.00/month in rent, has $1,000.00 of expenses, and $500.00 cash flow for you. You are the boss of that money too. That is Job #2 for your original money.

- Two years later, you have put that 2x $500.00 as additional contributions into your insurance policy and keep your regular payments as before. That is another $60,000.00. That’s Job #3 of your money. It now keeps receiving compound interest together with all the other money in your policy. Guess what? As the boss, you will ask your insurance company to give you a loan for that additional money as well.

- You again buy 2 new properties, generate another $1,000.00/month and keep the wheel rolling this way. That is Job #4 for the original money.

Not only are you in charge but the original money that you paid into your policy is now working to increase in your policy (remember you never took it out, you just took a loan on it) and you now own 4 properties that all work and generate cash flow. If you are lucky the value of your properties will also increase over time and maybe you even increase the rent a little and in turn increase your cash flow.

The main point is that you as the boss of your money have it working 4 jobs simultaneously for you and if you keep going it will add more jobs every 2 years, maybe even faster. That’s like having 4 employees that you are the boss of.

Can you see? Pretty soon you don’t have to work yourself at all anymore because you can just “boss your money/employees around” and never have to worry what others want or tell you and try to dictate.

You can be the boss — it’s not hard. All it takes is discipline and patience.

If you are in your 30’s or 40’s and put $1500/month in your future, it will only take about 10–12 years and you will be the kind of boss and owner of assets who never ever will work another job in her life. It sounds like a long time, but how many people do you know who retired @ 35 or 45 years old? That could be you and you are in total control to make it happen.

If you have questions or like my help, just let me know.

For more information on how to take that first step towards becoming the boss of your money, check out the IDEAL Investor Podcast.