Money printing has consequences — what can we do to avoid direct effects?

Million, Billion, Trillion

I recall pretty clearly that it was special to hear or read that something cost millions of Dollars or some government department spent millions on something. In rare cases, there were programs that needed Billions. I remember the mortgage crisis where reports came out that the government was supporting different groups, banks, etc. with Billions of Dollars. At the time, each newscaster emphasized “Billion with a B”.

In late 2019, we had a stock market correction — does anybody remember? Yes, a correction that showed that we had a lot of zombie companies in the market. A zombie company is a company that is not making enough money to pay its bills and not even enough to pay the interest on its loans. It keeps going out to banks and lenders to borrow more money so they can pay off one credit line with the next.

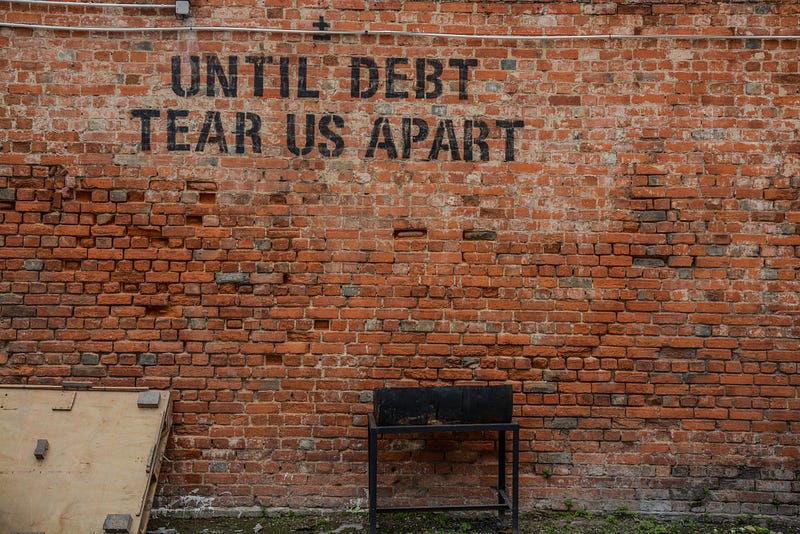

If you look around, there are some people who I call “financial zombies”. They started with a few simple purchases using their credit card, often while still in college. At some point, they reached the limit on the card and the monthly payments kept rising. At the same time, they get one offer after another for new cards. Naturally, they realize that they could get money from one card to pay the other. The new pays the old. Normally, when your income is not sufficient anymore, and you are maxed out on too many cards, you have to declare bankruptcy. You turn into a financial zombie when the government comes out with programs that allow you to suspend payments, restructure your debts, etc. instead of letting you fail and start over.

The same is true with the correction in late 2019. When stocks suddenly collapsed, the FED stepped in and provided massive amounts of funding. Most people didn’t even take notice but that was the start of the current debt and money printing spike.

With the pandemic raging more severely than in any other country in the world, the FED keeps printing money to the order of about 6 Trillion Dollars. Yes, — with a “T”.

We have actually gotten used to that term and the media tells us almost daily that we need more fiscal stimulus, more trillions to help us make it through the crisis. I believe we have given up trying to understand what a Trillion really is. Yes, it is 1000 Billion. A Billion is 1000 Million. So a Trillion is 1 million Million — crazy to even imagine.

If we look at the bigger picture, the United States will probably reach about 27 Trillion Dollars in national debt by the end of 2020. Since that number is so large, what does it actually mean? Well, it is about 100% of GDP.

GDP is the value of all goods and services we produce as a country in one year.

Why is this an important milestone? When one person is giving the other person money as a loan there needs to be an expectation that the loan can be repaid. It’s not so much a matter of the actual payment but the belief and trust that the person you give the money to is able and trustworthy to pay back the money.

The same is true for countries and governments. It’s not that well known, but other countries are actually holding our debt. The two countries that hold the biggest amounts of our debt are China and Japan.

Whenever the United States wants to borrow money it issues bonds. Bonds are papers that promise to repay the money that we are borrowing plus interest. Other countries take the paper and secure the money we want to borrow. On the bonds, it is written that we promise to pay back what we owe.

What do you think about anybody who is constantly borrowing money and has now reached a point where all the money that is borrowed is at the same level as the value of everything they produce? Just think about that. The value of what they produce. Not the money they earn. The US Government “earns” income from taxes and fees. That’s just a fraction of the value that everybody in the United States produces as value. The income from taxes is only about 3.5 Trillion in 2020.

So what happens when you gave someone a loan and find out that they have 3.5 income and 27 in debt and keep taking on more debt as if there is no limit?

I believe it is totally normal to assume that those countries that hold our debt are getting a little uncomfortable and wondering if they can trust us.

The world saw us as trusted and respected as the global superpower, the moral police of the world, etc. Lately, we have turned many former allies or places we did a lot of commerce with into enemies. There are suggestions by the leaders in the US government not to pay the debt we owe in the bonds we issued.

How is it that a nation can print money with no value or services against it? How can we keep printing money and not produce anything with it — just send it to people and companies to spend it or buy more debt/credit cards?

The major reason is the fact that the US Dollar is the reserve currency of the world. Pretty much everything is paid in Dollars. Most international transactions happen in Dollars or calculated and transferred into Dollars.

What happens when we lose that status as the reserve currency?

Yes, the trust is lost. Yes, there will be turmoil. Some people say we will get enormous inflation. I don’t think it will be hyper-inflation, but a lot nonetheless.

A situation like this already exists in history, right about the time between World War I and World War II, in Austria. In his book “The World of Yesterday”, Stefan Zweig, who actually lived at that time, described it as follows:

“Every hotel in Vienna was filled with these vultures [foreign tourists]; they bought everything from toothbrushes to landed estates, they mopped up private collections and antique shop stocks before their owners, in their distress, woke to how they were being plundered. Humble hotel clerks from Switzerland, stenographers from Holland would put up in the deluxe suites of the Ringstrasse hotels. Incredible as it may seem, I can vouch for it as an eyewitness that Salzburg’s first-rate Hotel de l’Europe was occupied for a period by English unemployed, who, because of Britain’s generous dole were able to live more cheaply at that distinguished hostelry than in their slums at home. Whatever was not nailed down disappeared. The tidings of cheap living and cheap goods in Austria spread far and wide; greedy visitors came from Sweden from France.”

What this account describes is the fact that the value of the currency of the other countries increased so much that even homeless people and simple workers could come to Austria and live the high-life.

We might not see this extreme situation, but as investors, we need to ask ourselves how we prepare for a time in the near future where we have a lot more inflation and the value of our money is going down. How do we prepare to live in times of high inflation?

Step 1:

The first thing you need to ask right now is: What do I own that is doing better in times of inflation and what doesn’t do well.

The stock market typically collapses when the economy struggles and inflation is high. Real estate and real assets do comparatively well. That’s in part because the rising tide is floating all boats.

If you bought a house for $100,000.00 in 2018 and now we have a lot of inflation and all similar houses now cost $200,000.00 to buy, your house has increased to that price as well. That’s just because the cost of everything has gone up with inflation and keeps going up.

That also means your rent from your tenants keeps going up. As prices increase everything costs more, including rent, and to pay for things, people need to make more money from their work. For you, as the investor, this means that you can pay down your mortgages quicker.

Step 2

If we don’t get hyperinflation, which means prices increase by 50% or more per month, it will be important to have access to cash. The paper the money is printed on is losing value by the day. If opportunities like the one described about Austria in the 1920s occurred, you want to take advantage. To do that, you need to build cash reserves now. Hold cash or something that you quickly convert into cash. I like gold. You can turn it into cash all over the world. A small amount will be worth a fortune in times of high inflation. Some people believe that gold will cost $5000 or more/ounce in today’s value. Imagine you only had to have 1 gold coin in your pocket and could pay for a ton of stuff easily.

Step 3

You do not want to own anything that is considered a long-term fixed-income investment. Bonds are such an investment or anything that pays you dividends. If we had 15% inflation and you have a 10-year bond from 2018 that pays you 2% interest, you are losing money and the bond itself is losing value because it is in US Dollar currency. Get rid of long-term fixed-income investments, if you have any.

Step 4

If you still have any adjustable-rate debt, immediately convert it into fixed-rate debt. I can’t imagine that anybody still has any adjustable-rate mortgages when we currently have historically low interest rates. However, if you do have any adjustable-rate debt, convert it into long-term debt.

What we often forget is that credit cards are adjustable-rate and high interest. If you have any equity in any of your assets, convert your credit card debt into mortgage debt. I would even refinance if you have to. With strong inflation coming the associated costs of refinancing might be somewhat painful now, but soon they will have been well worth it.

Step 5

For all your real asset inventory in your portfolio, start developing a detailed list of things that will improve the long-term value of your asset. Have that list ready. As inflation comes around, you will improve your property for a small fraction of the value that you would need to spend now. As you know we always suggest applying the 5/5/5/ rule.

That rule says that you should always take 5% of your rental income and put it into savings for vacancy. Another 5% for maintenance and minor repair. The last 5% is for CAPEX, major repairs that will increase the value of your property.

As you apply the 5/5/5/ rule each month the amount of money that accumulates in the accounts could be substantial. Ask yourself how much will you realistically need on brief notice. For that amount, you apply Step 2 so you have a modest amount of cash on hand. We should convert the rest into gold so the value increases with inflation, maybe even more. If you don’t want to hold actual hold coins or bars (which I recommend), you can follow Warren Buffett and invest some money in gold mining stocks. Just be aware that it might be harder than today to convert that back into cash.

If you follow these steps now, it will better prepare you for the coming financial crisis.

The more you can make sure you have flexibility and access to cash, the more you will take advantage of amazing, unheard deals while holding on to your portfolio and keep collecting ever-increasing positive cash flow from your properties.