Making mortgages more expensive can significantly reduce investor cash flow.

Have you heard about G-Fees? Probably not.

I became aware of them in more detail for the first time last year but more directly a few days ago.

I am in the process of having a second home built in Florida and suddenly got a notification from my lender that he could no longer finance the purchase, even though I had already received pre-approval.

When I asked him if anything changed in my data, he said:

“No, it’s not you, it’s us. Our bank has decided (not me but our management) not to continue any second home loans anymore, unless they were already in closing.”

Wow, I thought, now I have to find a new way to get it financed unexpectedly.

That also triggered me to check what the reason for the bank could be.

They did not really disclose the true reason, so I started digging and found a great article by Kerry Smith from Florida Realtor. Here are a few excerpts of what Kerry wrote:

FHFA is increasing the “G-fee” on most high-balance and second-home mortgages. Translation: After April 1, buyers seeking these loans will pay a bit more

WASHINGTON — On Wednesday, the Federal Housing Finance Agency (FHFA) announced an increase in Fannie Mae and Freddie Mac’s upfront fees for some high-balance and second-home loans. The increase in the so-called “G-fees” begins on April 1, 2022, according to FHFA’s announcement.

More than half of all mortgages, once originated by a lender, are sold to either Fannie Mae or Freddie Mac. The system provides liquidity to the U.S. mortgage market and allows local lenders to finance even more loans. FHFA uses money generated by the G-fees — essentially a surcharge to loans they purchase — to support affordable housing through programs such as HomeReady, Home Possible, HFA Preferred and HFA Advantage.

Starting in April, G-fees for the affected high-balance home loans will increase between 0.25% and 0.75%, tiered by loan-to-value ratio. Fannie Mae calls these high-balance loans; Freddie Mac calls them super-conforming loans. However, loans to first-time homebuyers in high-cost areas with incomes at or below 100% of area median income won’t have specific high balance upfront fees.

For second-home loans, upfront fees will increase between 1.125% and 3.875%, tiered by loan-to-value ratio.

The most shocking point is in this last part. I don’t know exactly how the tiered system works, but assuming my loan was somewhere in the middle, my regular interest rate would have gone from about 4% to 6% (2% G-fee). That is basically a 50% increase and makes these loans very uncompetitive.

Personally, I would have thought it would have been nice if my lender would have completed the loans they previously approved as these new fees only start in April and we would have long been done with everything by then.

There is another aspect to consider.

For anybody also contemplating getting a second home, see if you can still find a lender who is willing to finance it now, before the big change. I was also kicked off the list because I am a California resident and all the additional rules the state imposes on everybody else mean that lenders don’t want to work with people residing in CA anymore, even though the property to finance is in Florida. You might be lucky and not live in California, so you still have a chance until April fool’s day hits.

In Kerry’s article, there was also mention of increases in fees for regular mortgages.

This will hit everybody from people who want to buy a new house to people who want to invest in real estate.

I find it very aggravating that the government is now using these fees as hidden interest increases.

Think about it:

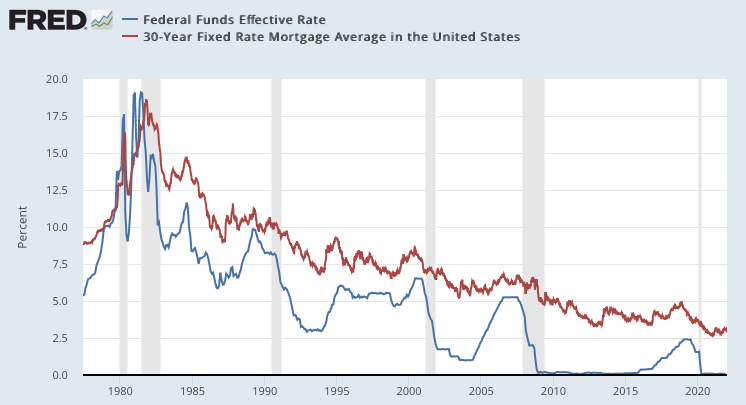

The FED has announced that they will increase FED rates 3–4 times in 2022. In the past — and there is no reason to think it will be any different going forward, the mortgage interest rates move in lockstep with the FED rates. Take a look at the image below. It shows the continuous decline in FED interest rates and how mortgages followed, but it also shows the few times the FED increased, and mortgage rates did the same:

What does this have to do with the G-Fees?

Well, normally a FED rate hike is identified as an increase in rates by 0.25%. So, 3–4 hikes in 2022 would mean up to 1% higher FED rates by the end of the year.

That also means a mortgage for an owner-occupied property will probably be around 4.25% interest and investment property mortgages would be 5–6% interest.

If you go back to Kerry’s article, you’ll see that there is another 0.25% — 0.5% increase through G-fees. That’s the equivalent of 1–2 more FED rate hikes just due to these fees.

Right now, I can get investment mortgages for about 4%. On my $240.000 loan that would have resulted in a mortgage payment of $1146/month (just for the loan not including taxes and insurance).

If I get the loan at the end of 2022 with the FED hikes and G-fees applied, that same loan would cost $1363/month.

The way this can ruin your investment success is through cash flow reduction.

Let’s say my costs for property taxes and insurance are $400/month.

That means right now I would have a total of about $1550/month in those costs + any property management fees I have for the investment. That’s typically 10% of the rent. If I can rent the property for $2300/month my total expenses would be $1750/month ($1550 + $200 for property management) and I take home $550 in cash flow.

If I assume 5% for vacancy reserve, 5% for maintenance, and 5% for major CAPEX repairs in the future that would be another $300/month. My true cash flow would only be $250/month.

Now, look at that same example with the FED hikes and G-fees applied. As you saw above, those impact my $240.000 property with about $215/month.

I call my investment success ruined when I only take home $35/month on a quarter-million-dollar investment. What do you think?

I say G-fees stink and amount to a hidden FED rate hike, not just for second homes but also for regular mortgages on investment properties.

Politicians constantly try to make you believe that they want to “help the little guy”. In reality, they don’t want to let any of us create any assets, even small investment homes, so they can keep us in regular jobs that require the highest tax and fee rates.

This new twist makes it harder to succeed but for me and my team, it only means to dig deeper and find solutions that allow you to develop a passive income portfolio and reach the Time Freedom Point where you no longer have to exchange time for money sooner rather than later.

If you like to learn how, please get in touch and let us help you.