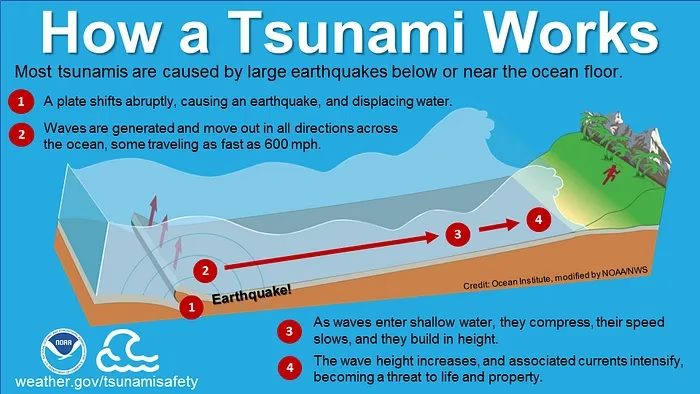

Tsunamis, which can travel over the ocean surface from many hundreds of miles, can be generated when chunks of the planet’s crust separate under the seafloor, causing an earthquake. Here’s what happens: One slab of lifting crust essentially rapidly acts as a giant paddle, transferring its energy to the water.

The true impact of the tsunami is felt when it hits the shore…

Today I am going to do something different than my regular articles. I am going to review a piece of writing that is less than 1 year old, and put it into perspective to today, and more importantly for what’s coming in the next 3–12 months.

Before we dive in, let me quickly explain how Tsunamis work according to

http://lifesciences.com:

Think of the US Federal Reserve as the one that triggered the earthquake with a paddle called “rate-hikes”.

Peter Tanous, on January 27, 2022 wrote (with amendments and comments on my part in ():

Adam McKay’s recent movie, “Don’t Look Up,” was a timely example of how our elected leaders react to crises. In the film, a comet is about to destroy all civilization, but the country’s leaders don’t pay much attention until it is too late and we are all doomed.

Welcome to our next major debt crisis.

In just a few years (actually starting in 2022 and getting worse in the coming years,) over half of every dollar we pay in income taxes will go to pay the interest on our national debt owned by the public. And it will get worse.

When that financial comet (tsunami) strikes, what will our politicians say or do?

First, let’s have a look at how we got here.

Most informed Americans are aware that the national debt and interest rates are both rising. Americans will soon wake up to the fact that the interest on our national debt is costing taxpayers a frightening percentage of our national income and wealth.

The comet (tsunami) is about to hit.

According to the U.S. Treasury, in fiscal 2021, the amount of interest paid on the national debt was $562 billion, including government transfers. The amount actually paid out to holders of U.S. securities was $413 billion.

That figure alone, which is over 20% of what we paid in income taxes in FY 2021, should be alarming when compared to other government expenditures.

Compare the $413 billion we pay in interest to holders of these securities to the annual budgets of other parts of the government. The State Department annual budget is “only” $35 billion, and the Justice Department $39 billion.

But this interest rate crisis will soon get worse, a lot worse.

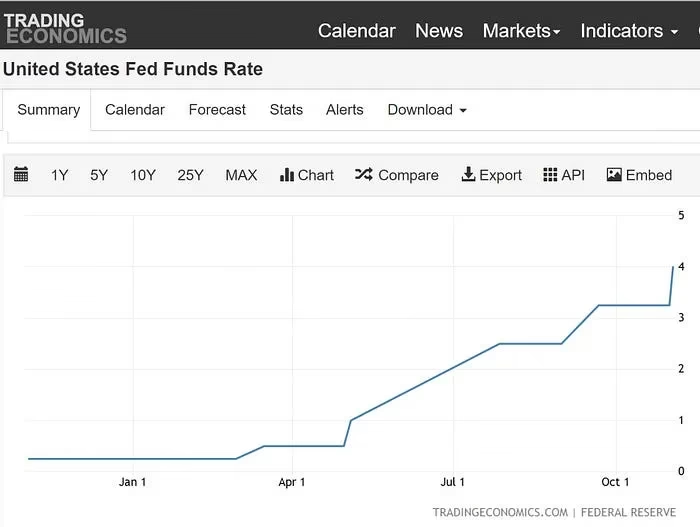

Cost of debt is on the rise

Here’s why: According to the Congressional Budget Office, the average interest rate paid on the national debt in FY 2021 was approximately 1.5%, historically a very low figure.

(When Peter wrote this article, the increases of 2022 had not yet happened. Now, in late November we have seen several raises and everybody expects another one early December. After that, the FED funds rate will be above 4%. It started the year at 0.25% — 16x times lower.

A lot of people, especially in the media make the mistake and mislead the public when reporting that the interest rate is now 3.5+% higher than it was at the start of the year. That is nominally true but the impact is much worse. We don’t pay 3.5% more, we pay 16x as much.

As Peter mentioned above, the average interest rate we had to pay in 2021 was 1.5% while the FED rate was 0.25%. If we add 1.25% to the FED rate at the end of 2022, we land at 5.25%. Let’s pick up the article from here.

As interest rates rise, which they have in dramatic fashion in January 2022, so will the interest rate paid on newly issued Treasury securities. While this is happening, our national debt is exploding.

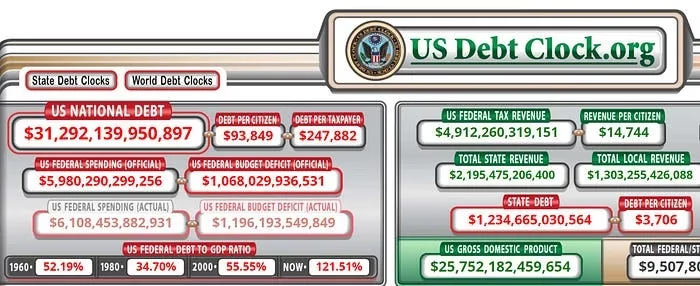

US Debt.org (added by me to illustrate current debt level)

In 2017, the national debt was $20 trillion. Just four years later, that amount is approaching (it actually has exceeded) $30 trillion. The recent stimulus programs brought on by the Covid crisis helped add a staggering $6 trillion to the total.

The math is easy.

Interest rates are still near an all-time low (they were in Januaray 2022 when the article was written). According to the Monthly Treasury Statement, in 2001, interest paid on the national debt was an average of 5.4%, about 3½ times what it is now.

If we get back to that rate, which is far from inconceivable, interest on the debt would cost American taxpayers $1.4 trillion, based on our present level of the national debt. That is twice the budget of the Defense Department.

In FY 2021, the total amount of personal income taxes collected was $1.9 trillion. Moreover, the future budget deficits projected by economists will add over a trillion dollars a year to the overall debt, adding substantially to the rising interest cost.

The interest rate comet (tsunami) is now visible on the horizon.

Americans will not stand for a situation where most of the income taxes we pay go to pay interest to holders of our national debt who live in Japan, China, the U.K., along with others here who own Treasury securities.

How will Congress react to this crisis? We won’t have to wait too long to find out.

Peter Tanous is an author and the founder and chairman of Lynx Investment Advisory. His most recent book is The Pure Equity Plus Plan. He has also written two books with CNBC.com Finance Editor Jeff Cox.

(This is my biggest issue and warning. So far, Congress, our geriatric leaders, and politicians on all state levels have always believed they can cure problems by throwing more money at it. In this case, money is the trigger of the tsunami.

One would think the cure would obviously be removing money from the system.

Could that work?

Maybe — but I doubt it.

Her is why: Ask yourself how the political process works. People who want to get elected or reelected are holding events where they promise to make your life better. YOU decide who of them to elect, hoping against hope that they did not lie to you, as they always have since you reached voting age.

Well, they did lie again, as they always do but they want to keep the outright outbreak of violence under control, so they do a few things they mentioned. Most of that involves still more spending.

This year alone, we are getting money thrown at infrastructure, computer chips, and green energy for a total of about $2 Trillion.

It’s not only on the federal level.

In Michigan, the governor, Gretchen Widmer, gave $100 million to Ford to create 4000 new blue-collar jobs needed to build green cars in the state. Ford did exactly that and then fired 4000 white-collared jobs from their ICE vehicle management that will no longer be needed as electric vehicles need less manpower. Great deal.

This happens everywhere.

What can you do?

When a tsunami is about it hit the shore, you are advised to quickly seek higher ground. In this case, you should use the time you have to look where that higher ground might be. It could be outside of the United States.

I believe we have such a depth of division and pent-up anger that actual drastic measures that will be needed to avoid a total collapse of the monetary system could lead to violence and even a civil war.)