Some tips on how to become more patient

We live in a world where everything seems to happen at the speed of light. We want instant gratification, instant feedback, instant solutions.

We are constantly bombarded with messages that tell us to…

Hurry up… act now… seize the moment!

We are addicted to the adrenaline rush of doing things quickly and efficiently.

But what are we sacrificing in the process?

What are we missing out on when we don’t take the time to slow down, to reflect, to appreciate? What are the consequences of our impatience for our personal and professional lives?

One of the areas where impatience can have a negative impact is investing.

There is a huge difference from gambling. If you decide you want to gamble and you are of a clear mind, you know that there is a significant chance that you will lose whatever you are risking in the gamble. Think of putting money on red or black in a casino.

That’s why I see the stock market and the media outlets reporting about it 24/7 as a form of gambling.

Why You Need Patience

Investing is a long-term game that requires patience, discipline, and foresight. It is not about chasing the latest trends, jumping on the bandwagon, or following the crowd. It is about having a clear vision of your goals, a sound strategy to achieve them, and a willingness to stick to it through thick and thin.

Impatient investors tend to make rash decisions based on emotions, not logic. They are easily swayed by market fluctuations, media hype, or peer pressure. They are prone to overreacting, panic selling, or chasing returns. They are more likely to incur losses, fees, taxes, and missed opportunities.

Case in point: Tesla

Most of my regular readers know that I am a Tesla fanboy. It’s one of two companies I own stock in. The other one is Palantir.

As a shareholder, I want to know what the company is doing, how it is performing, and what it plans to do to increase the value of my investment in the long term.

I bought the stock to hold it till 2030 and possibly beyond.

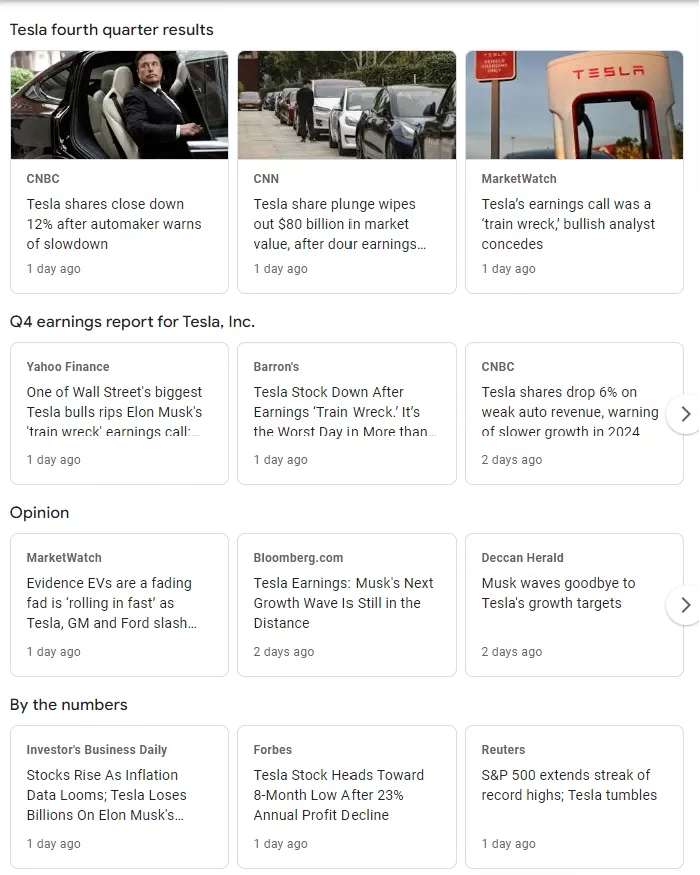

A few days ago, Tesla reported its results for 2023.

As always, the stock market casino operators (they call themselves Wall Street analysts) put their estimates of the performance out into the media so we can all compare how close the company came to those estimates.

How many cars did it make and sell, how much profit did it generate, how many battery systems did it sell, etc.?

Tesla published the actual data for everybody to see and held a call to explain the results.

Across almost all metrics, the casino operates care about the company met or exceeded the estimates.

When, during the call, and after reading the public announcement,t the question was raised about how 2024 and 2025 will look for the company, the leaders said:

We are in a challenging market and think we might not grow as fast as we did last year.

While the meeting about the results was proceeding, the media decided what it wanted to message about Tesla to be.

The stock price fell about 15% within one day.

Why?

Because we are irrational, impressionable beings, many without conviction.

I am convinced of the long-term success of Tesla, and the 2023 results and meeting explanation did not indicate that anything about the company, its goals, or the way it works has changed.

Yes, in 2024 it might not grow as fast as in 2023. I invested in the company because I believe in their mission, their ability to execute this vision and mission, on the growth that comes from this execution, and the long-term success in the marketplace.

Are you a gambler?

The casino gamblers hope for short-term profits from price actions like this most recent one, triggered by the media declaring, without evidence, that the company, from one day to the next, is no longer as valuable as they told us last week.

Patient investors have a different mindset. They understand that investing is a marathon, not a sprint.

They know that markets go through cycles of ups and downs, and that volatility is inevitable.

They are not distracted by short-term noise but focus on long-term trends.

They are confident in their plan and do not let fear or greed cloud their judgment.

They are more likely to reap the rewards of compounding, diversification, and value investing.

When you look at these irrational, media-triggered, casino operator-preferred reactions for a few years, you can take wonderful advantage of them in the form of purchasing opportunities.

Tom Nash has a great system for that.

He says: If you have decided that a company is a good investment based on solid research and data, set aside a certain amount of money you use to purchase the stock each month, say $200.

When you see an irrational downturn, especially when it is very quick, like after our Tesla annual earnings call for 2023 last week, use double the monthly money to invest.

If you do that consistently, you perfectly combine dollar-cost averaging with buying the dip.

I am not giving investing advice here, but an approach to maximize your return.

If you always put $200 each month in your preferred stock, you get more stocks when the stock price is down a little and fewer when the stock price is up a little.

During extreme dips, you grow your portfolio more rapidly because you get significantly more stocks for your money. That’s why you should try to use double the money you would normally invest.

In the long run, you will have more stock at a lower average purchasing price.

My main support, service, and mentoring activities are focused on residential real estate investing. That’s another field that requires patience, probably more even than the stock market.

Patience is not only important for investing but for any endeavor that requires time, effort, and perseverance.

Whether it is learning a new skill, starting a business, writing a book, or pursuing a dream, patience is the key to success.

Patience allows us to overcome challenges, learn from mistakes, and grow as individuals.

Patience gives us the perspective to see the big picture, the resilience to cope with setbacks, and the gratitude to appreciate what we have.

Patience is a virtue that we can cultivate and practice in our daily lives.

Here are some tips on how to become more patient

- Set realistic expectations. Don’t expect things to happen overnight or according to your schedule. Be flexible and adaptable to changing circumstances.

- Plan ahead. Don’t leave things to the last minute or procrastinate. Anticipate potential problems and prepare for them.

- Breathe deeply. Don’t let stress or frustration get the best of you. Take a few deep breaths and calm yourself down.

- Think positively. Don’t dwell on the negative or complain about what you can’t control. Focus on the positive and look for opportunities.

- Seek support. Don’t isolate yourself or suffer in silence. Reach out to others who can help you or empathize with you.

- Reward yourself. Don’t forget to celebrate your achievements and progress. Treat yourself to something you enjoy or share your success with others.

Patience is not a weakness, but a strength.

It is not a hindrance, but an advantage.

It is not a burden, but a blessing.

In a fast-paced world where everyone is in a hurry, patience can make all the difference.

Patience, finally, allows us to reflect calmly. If you would like to reflect calmly with me, subscribe and join our community. I look forward to being patient together with you.