Why diversification is so important for the smart investor

In the last few weeks and months I have been asking myself the following questions:

- Is the pandemic over?

- Has the economy recovered from the pandemic?

- Will inflation disappear again?

- Will housing prices and rental costs go back to 2019 levels?

- Will I get a reasonable interest rate for my savings soon?

- Can the stock market go up forever?

- Honey, the neighbor told me that stocks are rising — should we buy some?

I am curious what your answers are. For me, the answer to all the questions is: “No”.

That said, I just read online that the US stock market indices reached new all-time highs by the end of the week of 25 Jul (maybe more by the time you read this article.)

As a person who invests for passive income through real estate, I wondered if this has happened before and if any history shows that this seemingly never-ending increase in stock prices would stop or turn around.

Never before in history has a trend like this persisted so long.

When you ask people if there is an explanation or what is likely to happen soon, I most often hear: “Yes, this is unprecedented but this time it’s different”.

That statement is often followed by:

“We never had interest rates this low.”

“We never had a situation without alternative, meaning there is no other place to invest that performance like this.”

“Money has never been as cheap as this.”

“There has never been this much money printing and flooded into the market by the FED as in the last few years.”

“I don’t see any alternatives and I want to take part in these insane gains.”

I looked a little deeper and found some evidence from the past that can be informative and led me to the title of this article.

One of the important factors to consider is “sentiment”.

Two forms are regularly measured and updated. One is called investor sentiment, the other consumer sentiment.

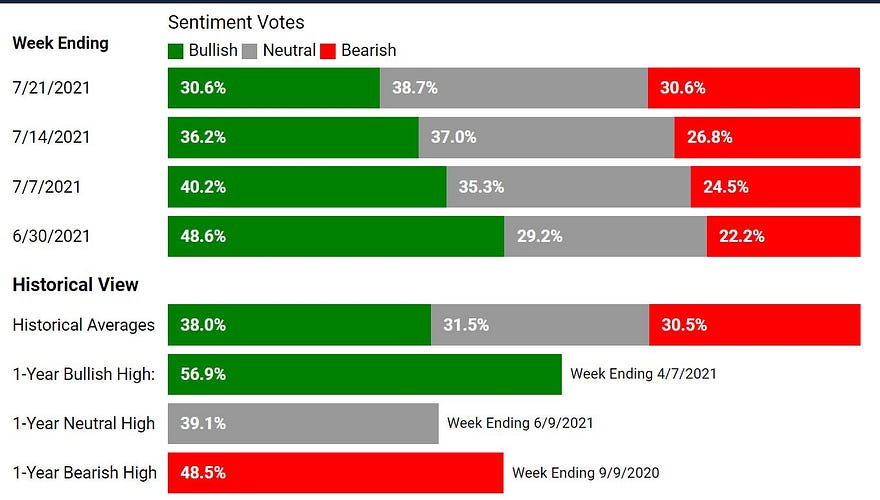

If we look at investor sentiment here is what I found:

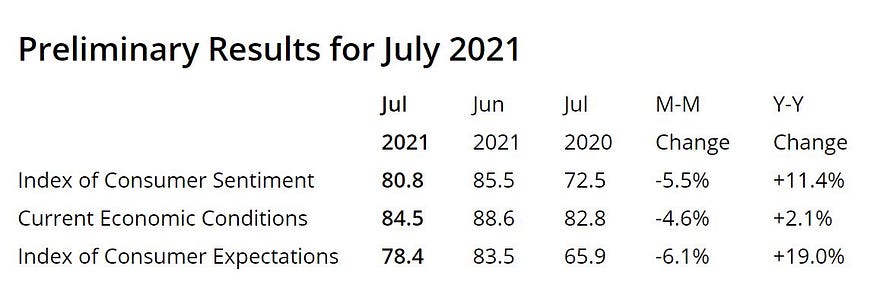

Investors’ and consumers’ views are still extremely optimistic, even though they came down a little in the last few weeks. A very optimistic outlook provides reasons why stocks should keep increasing in value and indices should reach new all-time highs.

Investor Sentiment

Consumer Sentiment

When too many people get all excited and optimistic about the economy and stock markets caution is warranted.

The term “Irrational Exuberance originated from former FED chairman Alan Greenspan. After Greenspan said this term as part of a dinner speech in 1996 stock markets around the world came down 2–5% overnight. He became famous for it even though he never used it again.

“But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?” He added that “We as central bankers need not be concerned if a collapsing financial asset bubble does not threaten to impair the real economy, its production, jobs, and price stability.”

As value investors, we need to ask ourselves how we can act and prepare for any changes that might come.

I personally believe (no financial advice) that the valuations we have reached are no longer aligned with the performance of the companies listed at the stock exchanges.

One reason for this is the change of the rules for what is a reasonable ratio of price and value. It used to be normal that long terms established stocks of very large companies had a ratio between 5–15 and very new, fast-growing tech companies had ratios between 15–25.

Now we can find ratios of 100, 200, 500, etc. That is exuberance.

For us investors in real estate, we also have to focus on performance. If we can find properties that provide positive cash flow without any changes to the rules, we can buy them, even if the prices are elevated.

If you have to massage the rules to make a deal look like it could work, you should stay away.

I can’t tell when, but I am convinced that the law of gravity still exists and when the stocks have reached the point where they can’t fly any higher, gravity will bring them back.

Nobody knows how much, but we should be prepared that it could be a lot.

That’s why diversification is so important. You can participate in the irrational exuberance to be part of that game while you also invest in real estate properties, gold, silver, currencies, etc.

Just make sure that the performance meets your goals and that you don’t have all your eggs in one basket.