It took a lot of things to happen all at once but now you need to take action

It isn’t totally clear when the official start date of COVID19 in the United States will ultimately be when historians had a chance to write the history of our time. I would say we probably have lived in it for 8 months now.

Many years ago a very respected expert in commodities trading, Jim Sinclair, coined the term GOTS.

It is an abbreviation that stands for “Get Out of The System”

What system is he talking about and why would that be important now more than in the last few decades?

To understand you have to ask a few questions and reflect on the answers:

- What is the fundamental basis of our economic system?

We used to have a system where you would buy things that merchants offer when you had saved enough money to pay for it. That’s probably what your parents and grandparents told you when you asked them how they bought their first car or their first own clothes, etc. You went to a store and paid in cash for what you desired.

At some point, banks had the great idea that the application of credit that was common for industrial production could be extended to the public.

Originally, credit as loans was given to companies that had large projects. The banks loaned the money and the companies would pay it back based on the income from the goods they produced and sold. Think car manufacturing, anything to do with large machinery, as well as agriculture. Banks gave the money to the farmer to buy the seed, knowing that the sale of the crop would allow the farmer to repay the loans.

Consumer loans, especially credit cards were invented to allow a consumer to buy something now and pay it back when the next paycheck came in. That is still the system in Europe. What we call a credit card really only provides credit for 1 month, paycheck to paycheck.

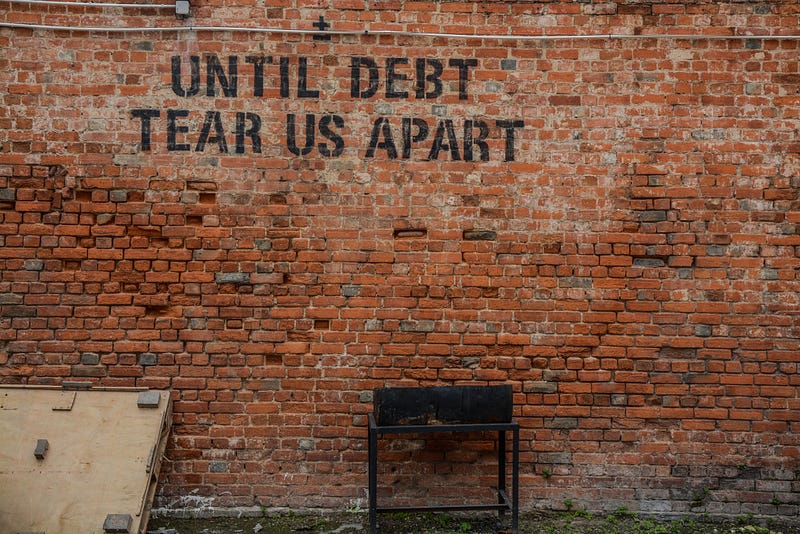

It became quickly apparent that people would by more stuff if they had more time to pay back the loans. That’s when banks invented credit cards that are based on a calculation of a 30 year or 40 year loan. If you over wondered why your minimum payment is so low, it’s because the amount you spend s spread over 30 years. That also means that $100 coat that you bought for Christmas actually costs you $350 — $500 when you add all the interest into it.

For small items, that worked and people are pretty blind to how credit cards work. For larger items, banks were initially hesitant and only wanted to give large loans for things that would keep their value. That’s where mortgages come in. The house you buy now with a 30-year mortgage will still have value in 30 years, probably more than you paid for it now. In case you decided to stop paying for the mortgage the bank would seize the house and sell it. remember the housing crisis of 2007–2010.

Then, there are medium-value items, thinks like cars, appliances, etc. Initially, banks thought you should have the option to get a loan for it but not via credit card. It became normal to have car loans for 2–3 years. In a sense, if you could afford to pay that much per month for a car you really wanted it.

To increase sales, carmakers decided they could get into the credit business and began offering car loans directly. You have seen many times loans for extra low-interest rates like 0.9%, 1.99%, etc.

As people piled on more and more credit for houses, car loans, store credit cards, and regular credit cards for daily purchases, the ability to pay a short-term car loan was reduced more and more. While people wanted ever bigger cards, and especially love SUV’s and trucks, which are much more expensive than regular cars, the length of car loans got longer and longer. Now you can get a car loan for 8 years.

Naturally, people don’t like to drive around in old cars. Most people don’t keep a new car for over 6 years, often shorter. That means you re going to buy a new car before you paid for the old one. “No problem” — is what the dealers tell you. Do you have $10,000.00 in the balance left on your $50,000.00 SUV? We’ll just roll that into your new purchase. Now, you have a $60,000.00 new SUV with $10,000.00 remaining from the old one + the new one and because you want to keep your monthly payment about the same, your loan is extended to 99 months. How cool is that? You have a brand new vehicle at the same cost as the old one with all these new fancy features.

A recent study completed before anybody knew about COVID 19 showed that Americans are not saving but are “Master Spenders”. That level of spending is based on credit and does not account for emergencies. Most people would struggle if they suddenly had to pay $1000 or $2000 for an unforeseen expense.

Our system is based on credit and the assumption that we will have income.

That is part of the system you have to GOTS.

2. How do we plan for retirement?

For those people who have regular jobs, the planning for retirement is based on government support retirement plans. You have heard about 401K, IRA, etc. In very basic terms, these programs take money from your paycheck every month and transfer them to a financial institution where a mutual fund manager is collecting it for a lot of people and investing it into the funds you selected with the help of your employer.

If you have a generous employer they might add a little bit each month to your amount to increase your investments.

I don’t want to get into the details of the stupidity of 401K plans where you give someone your money to invest it for you, can’t get to it, don’t know what it is invested in, and have to pay a fine when you want to take some of it before you retire. It’s horrible, but most people participate anyway.

More importantly for GOTS, ask yourself what the money is invested in? The funds that Fidelity and Vanguard and others collect from employers go mostly into stock mutual funds.

What happens when a fund defaults?

What happens when the companies in a fund default?

How do you prove that you own anything? Yes, you have a statement of your payments and your annual performance report. What shows your ownership?

3. How do we pay for anything and why is it important?

If you look at your daily life you realize that you are either making electronic transactions or pay cash for anything you buy. All these transactions are based on the US Dollar. (or Euro, Peco, etc. depending on where you live).

We know that the paper that currency is printed on does not have the value that the numbers say. The paper might be worth a fraction of a penny but if it says $20, you can buy goods and services for $20.

How does that actually work?

The money we are using is to help us make transactions. The actual value has to do with the value and services that are exchanged. If you work for 5 hours and your work created $20 of value for each hour, you can request $100 form the employer. If you looked at ancient times, a worker and a merchant exchanged value for value. you worked 5 hours and you received silver coins or gold coins that had the actual value of $100.

Now you could use these coins and exchange them for something else. You might buy something to eat for 1 of the coins and now you have the food and the merchant has the equivalent value in your coins.

It used to be until 1971, that you could receive a $50 bill and could go into a bank in America and exchange it for a little more than 1 ounce of gold. The paper money was supported by the actual value of gold. I recently wrote in detail about the history of the value of the US Dollar and it’s detachment from the Gold Standard, read more about that here.

To answer question #3, think about ways how you can have things of real value that cannot be eroded by the value of paper money. examples would be gold coins (and silver coins). You need to make sure that they come from the mint in your country. Americans should get American Eagle, Canadians the equivalent, Europeans coins for the German mint or Spanish mint, etc.

Why is that important? Isn’t gold the same everywhere. No, because government can make rules and politicians only care about their voters. As we have had before it is conceivable that the government might confiscate gold coins or make it illegal to use them if they re not from your country. Naturally the government would not want to make the voters angry and it is sold as a patriotic gesture to have gold coins from your own mint.

Do I hear you saying that that would never happen? Well, you are wrong. It has happened a bunch of times and owning gold was only legalized again in the 1980’s. It happened before and probably will happen again.

4. How can I own assets that will not lose value or be taken away in a major economic crisis like the one that is coming in 2021–2025?

Well, there are things that have value no matter what. Gold and silver are examples. Another area we are suggesting and are invested heavily is real estate. Yes, the prices could go extremely high if the Dollar is not worth much anymore. People might pay you rent in gold or silver coins.

The most important point is that real assets retain their value relative to the economy because they provide a service to the citizens. You have to live somewhere.

Theoretically, we could get a totally socialized system where the government seizes all assets and nobody can own anything anymore. Though that is theoretically possible, it is very unlikely to work in a country like America.

I believe, if anything, we might have certain things rationed (recall COVID 19 toilet paper and shopping empty shelves. Still, a totally socialistic system is a step too far for my imagination.

Finally — What should you do to prepare?

- Make sure that you own a lot of real assets like gold, silver, houses and nothing that is printed on paper

- If you want to keep stocks for some time, don’t keep them in mutual funds but ask to get your certificates of ownership send to you. It’s you right.

- For gold, get coins or bars form the mint of the country you live in or plan to move to

- For your residence, check if you live in the most suitable location. Now that we work a lot from home, see if you can do work from home in the most suitable location for your family. If you not already live there, move there.

- If you purchase get a property that has solar system, water collection, battery storage, install those systems using loans. (Keep in mind these loans will be almost worthless in a few years and easy to repay)

- Setup relationships with providers of food in large quantities. I have three large freezers and buy a steer, lots of other basic goods, and freeze them so you will not have any problems when there are shortages. This stuff could also become an amazing source of income in the worst case scenario.

- Check if you can find a property with a well or consider a water collection system with filtration. Again, finance with loans as those will be easy to repay in a few years.

- As many people have discovered during COVID 19 times, check into gardening. In case you move to a new location, see if it will allow you to do some gardening. Ideally, you will try to find a neighborhood where people all grow different crops in their gardens and then share so you have a nice wide variety throughout the year.

- Depending where you move, you might want to look for access to wood and maybe even some folks who hunt and fish to maintain a protein rich diet.

Some of these suggestions might sound like the recommendation of a prepper with utopian ideas of the future. That’s not why I write them down here. They are here because I think we need to adopt a new level of independence.

Just even 20 or 30 years ago, we would not have had easy and affordable access to the technology. We can now get:

- Solar panels on the roof

- Power Inverter in the garage

- Battery storage in the garage

- Electric water heaters to warm the water

- Access to compost, top soil and other things to live independently without spending huge amounts of money.

- Some people already to this and set a great examples. Check out MacKenzie and Spencer at Life Uncontained or Erin and Josh at Wild Wonderful Off-Grid.

I believe it is time to GOTS and the more signs we all detect of the endless money printing, deterioration in the economy, loss of trust by other countries and governments and many more, the sooner we should start checking where we stand and what we can do to get out of the current system and into a new sustainable one.

Oh yes, I have not even touched on Climate change. Do you honestly think the world will allow us to keep polluting recklessly without consequences? I don’t think, so but that’s something for another article in the near future.

Interested in learning about where to start on your path to getting out of the system? Download your free mindset manual