The Danger of CBDC (Central Bank Digital Currency)

Have you had a situation where you thought you knew something and it turns out what you believed all your life is not really true?

If you come to that realization for something that might be important to you but has not really had a huge impact on your livelihood, you might say: “wow, I never knew that” — and then move on with your life.

What happens if such a revelation actually affects your livelihood — or soon could?

Something like that recently happened to me — and, and I thought I was a good boy.

Let’s start at the beginning (any similarities with your life are totally coincidental):

When I was young I had dreams and wishes to buy things but my parents, although they were both working very hard, did not have a lot of money. I would call it — lower middle class. Their dream was to save enough money to be able to buy their own house.

Whenever my sister or I asked for something we were told: “You have to save your money until you can afford it”.

We had a small allowance and were both pretty good at math. That showed saving our allowance would take ‘forever’ to afford the things we wanted.

I decided that I would not want to ask for gifts anymore — you know, toys, soccer balls, stuff like that.

I told everybody in the family that if they wanted to make me happy it would be best to give me an envelope with money — for my birthday, when a tooth came out, for Christmas, Easter, end of the schools year, good grades, you get the idea.

My parents told everybody: “He is such a good saver!”

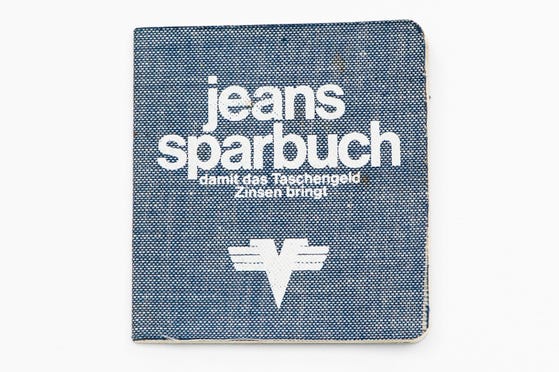

The local banks actually supported this idea. They wanted to be hip and started something called “The Jeans Sparbuch”. Amazingly that still exists today.

It was a small book that looked like the cover was made from Jeans fabric. The goal was to collect allowances, gifts from parents and family, then take the money — typically in cash — to the bank and have it deposited into the Jeans Sparbuch account. Each entry was meticulously tracked and once a year the holder of the little Jeans Sparbuch would go to the bank and record the interest that had accumulated.

At the time interest rates were 6–8% — unimaginable these days — and I still always felt disappointed when I saw the small amount of interest I had received at the end of the year.

While in middle school I started working at a nursery to make extra money — my first “own money” as I called it. I deposited it in my savings account — as a good saver would do and ultimately made the biggest purchase of my life — a mofa — basically a motorized bicycle.

Fast forward 40 years and I have always aimed to be a “good saver”.

When a study came out before the pandemic stating that 40% of Americans couldn’t handle a $400 financial emergency, my wife and I knew that we were part of the other 60% — because we are good savers.

In all these years banking has changed a lot and we all now have credit cards, debit cards, Apple pay, PayPal, etc. A lot of how we pay these days is digital.

As a way to help the environment, banks have convinced us that getting a printed statement of our savings, transactions, and balance is no longer necessary. We can review online and on our mobile devices at any time we want to.

Cash is less and less common and needed. We pay and transact digitally most of the time these days.

No more envelopes with banknotes on birthdays, etc. Now we get Amazon gift certificates or credit card look-alike gift cards.

That begs the question: Who owns the money in these accounts — especially your savings and checking accounts?

Turns out I was never “A good saver”. I was actually “a good creditor” — and you are probably too.

What I learned and was surprised about is the fact that I don’t own the money I put into my savings or checking account. I am actually getting into a contract with the bank where I loan them the money and they agree to pay interest on it (however little it might be).

The agreement also includes (look it up if you are curious) how I have access to the money I gave them.

Have you ever asked yourself why the bank would limit how much of what you probably considered “your money” you can pull from “your account” when going to the ATM machine?

That’s why. You gave the bank a loan and they pool all the loans together and then create mortgages, car loans, etc. from it. As soon as it is in their system, it’s not yours anymore until you literally pull it out of the accounts as cash.

Just as a quick side note: In case the bank (in the United States) you loaned your money to goes bankrupt, you are insured up to $250,000.00 by the federal government insurance. (Other countries have different insurance amounts for their banks). If you “loan” them more than that you will have to fight in the courts to get any of it back.

By now you might ask yourself what all that has to do with the danger of CBDC I wrote in the title.

That acronym CBDC stands for Central Bank Digital Currency.

Right now we have all the stuff we know, like savings accounts, checking accounts, mortgages, etc. and we know credit cards, debit cards, etc. All of that is digital and used digitally — BUT — at any time you want you can convert it back to cash.

Yes, there are rules you unknowingly agreed to when it comes to how much of the money you can convert into cash all at once or on a daily basis but you can.

You may have heard that the Chinese Central Bank has developed a “Digital Yuan” and is already running trials in preparation of using it officially starting with the Winter Olympics next year.

The European Central Bank is working on developing a digital Euro and the FED together with the US Treasury Department is conducting studies as part of the development of a digital Dollar.

Why is that dangerous?

Well, think about it. If you were to go to your bank and pull out the maximum amount of cash for as many days as it takes to withdraw all your money out of all bank accounts, you could do with that cash what you like.

You can buy a boat with cash (and a handshake — that’s considered a sufficient common law contract). Then you can sail to all the places around the world that accept the US Dollar as a legal currency. You can come ashore anywhere you like, buy anything you like with your cash dollars, etc.

Or you can decide to buy gold and silver coins, buy old cars, watches, or paintings as collectibles and pay for all of it with cash.

You could do with your cash money what you want and with very little effort you would make sure that it’s not a very public thing. Nobody would know.

If the central banks around the world get their way, we will soon all have only digital currency.

Why would they want that when all our transactions are already digital anyway?

Because they want more control.

They want to be able to say: “Times are bad and any of the money that your employer deposited on your behalf in your checking account will now have a holding fee of $5 for each transaction and as long as you have that money in the account you pay minus 2% in interest. Sorry, we have to do that due to economic conditions”.

Or they might say: “Your payment will have to be restricted because we can see that you are buying unhealthy foods all the time and will become a burden on society due to developing diabetes we can predict will befall you.”

Do you think that’s unrealistic?

As has become the norm lately, China is a little ahead of the US and Europe. They introduced what they call “The Social Score”.

The government said: “We have the social score so people can win prizes and be rewarded for good behavior.”

That may be true but it also tracks bad behavior. If you cross the street on a red light, drove too fast in a residential neighborhood, were caught without your mask on the way to work, …. — your score goes down.

People with scores below certain levels will not have access to the same benefits, will not be allowed to pay or buy certain things, etc. It’s a way of total control.

All this currently sounds pretty dystopian but all central banks already work on these digital currency systems.

We don’t really need them to buy things or make payments. The currently available privately developed digital systems we are all familiar with, like credit cards, debit cards, PayPal, Apple Pay, etc. work perfectly fine. The one thing they don’t provide is control because we still have the option to convert all our funds into cash.

Right now we have given loans to the bank we work with. If we get CBDC the power will shift to the government with the opportunities to control us — more or less.

I am not writing this to scare you or because I am paranoid.

I like to warn you and encourage you to inform yourself. In addition, you know that I have always recommended investing in residential real estate. That’s a tangible asset that will survive through all the turmoil and changes we will probably face in the next few years.

You might think that the government would never be allowed to have as much control of you as I am describing. If you are skeptical, just recall all the things you were no longer allowed to do during the pandemic. That was a great example of what is possible and we all couldn’t do anything about it.

If investing in real estate is too high a price right now, consider other valuable assets like gold coins (about $1800/ounce), or silver coins (about $35/ounce), or Whisky/paintings/watches/cars — collectibles. You could even look at Bitcoin as it isn’t controlled by governments.

In summary, I urge you to be vigilant about CBDC. Ask yourself how much money you want to loan to the banks and how you can build a portfolio of valuable assets so you will retain your freedom to decide what you want to do with your life — even when CBDC becomes a reality.